Jencap Blog: Insurance Insights & Resources

Keeping you up to date on industry trends so you maintain your competitive edge and provide timely, accurate coverages for your clients.

RECENT POSTS

FEATURED INSIGHTS

INSURANCE INDUSTRY TRENDS

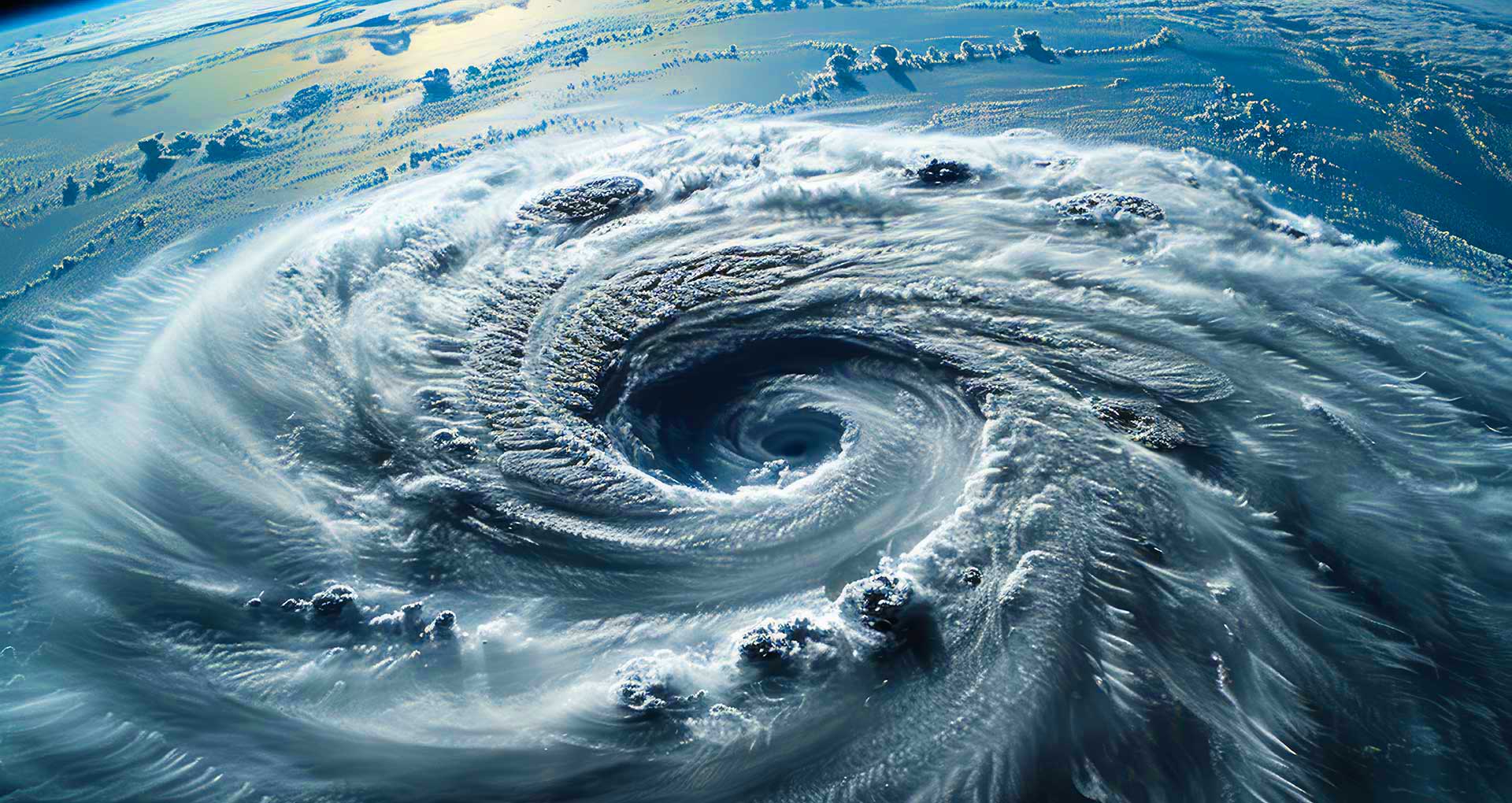

Cracking the CAT Modeling Code

As storms grow more unpredictable, the insurance industry is reassessing how we analyze and underwrite property risks.

TRENDS| Q1 2025 | 17 MINUTES

PODCAST | APRIL 24, 2025 | 16 MINUTES

The Big Build: Inside Construction Wrap-Up Programs

Kathryn Smith sits down with Michael Yovino and Josh Rogove to discuss navigating construction insurance, minimizing risk, and maximizing cost efficiencies.

ARTICLE | APR 10, 2025 | 3 MINUTES

The Costly Mistake: Why Many Operators Overlook Cannabis Product Liability Coverage

When it comes to insurance, many cannabis operators take a “check the box” approach. But, is that strategy dangerously short-sighted?

CONSTRUCTION

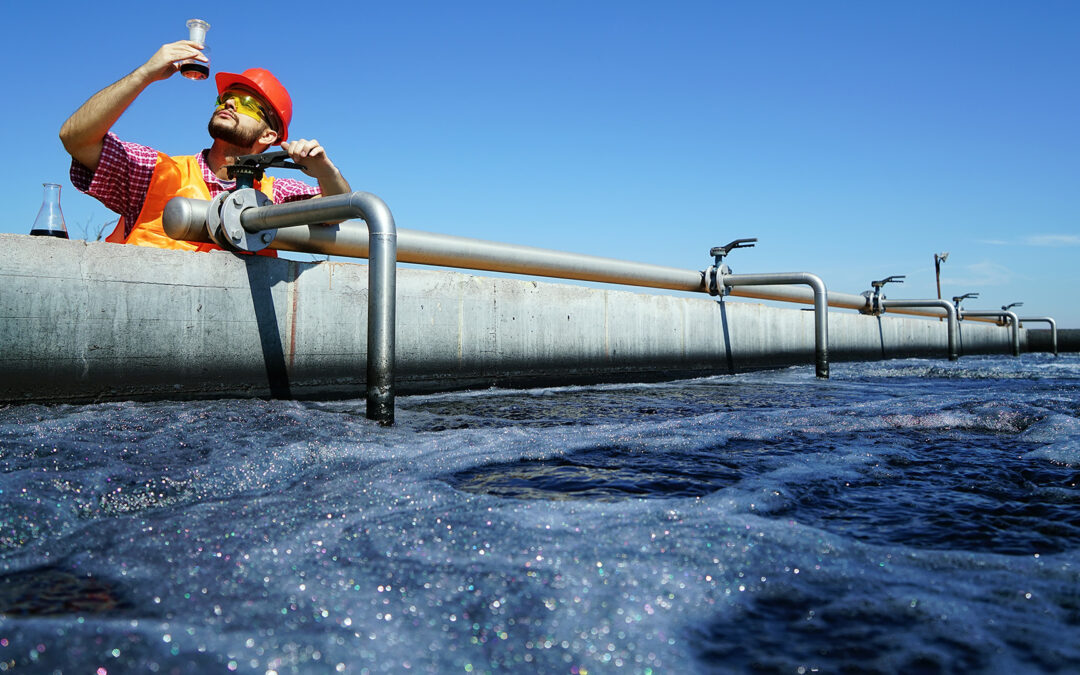

ENVIRONMENTAL

TRENDS | Q3 2024 | 3 MINUTES

Is Going Green Good?

In theory, “going green” is the better option, right? But it’s not always such a clear-cut answer. Two Jencap experts continue the ongoing debate.

PROPERTY

TRANSPORTATION

TRENDS | August 9, 2022

Garage Gurus: Garage Coverage Explained

Garage Insurance is one of the most commonly misunderstood lines of coverage. Jencap’s expert brokers are ready to clear up the confusion. We’ve parked answers to all of your Garage Insurance questions here.

WORKERS' COMPENSATION

SPOTLIGHT ON VIDEO

TRENDS & WHITE PAPERS

Cracking the CAT Modeling Code

As storms grow more unpredictable, the insurance industry is reassessing how we analyze and underwrite property risks.

TRENDS | Q1 2025 | 17 MINUTES

Is Going Green Good?

TRENDS | Q3 2024 | 3 MINUTES

Chronicles of Casualty

VIDEO SERIES | Q1 2024 | 46 MINUTES

Navigating the New Frontiers of Professional Lines Insurance

CASE STUDIES | Q1 2024 | 9 MINUTES

Preparing for The Future of Cannabis Insurance

WHITE PAPER | Q2 2023 | 7 MINUTES

Your Guide to Cannabis Insurance

TRENDS | UPDATED Q2 2023 | 6 MINUTES

How Climate Change is Shifting the Insurance Industry

WHITE PAPER | Q3 2022 | 17 MINUTES

Garage Gurus: Garage Coverage Explained

TRENDS | Q2 2022 | 5 MINUTES

Riding The Waves of Change Insurance Industry Outlook

WHITE PAPER | Q1 2022 | 3 MINUTES

PODCASTS

Hosted by Jencap’s Managing Director of Marketing, Kathryn Smith, Flip the Cap is the podcast where insurance insights flow and trending topics are always on tap!

RECENT POSTS

MORE INDUSTRY TOPICS

Stay Informed

Want to receive information from Jencap on timely marketplace trends, hot new product and program launches, and valuable product expertise that will set you up to win? Sign up below to receive email communications from Jencap.