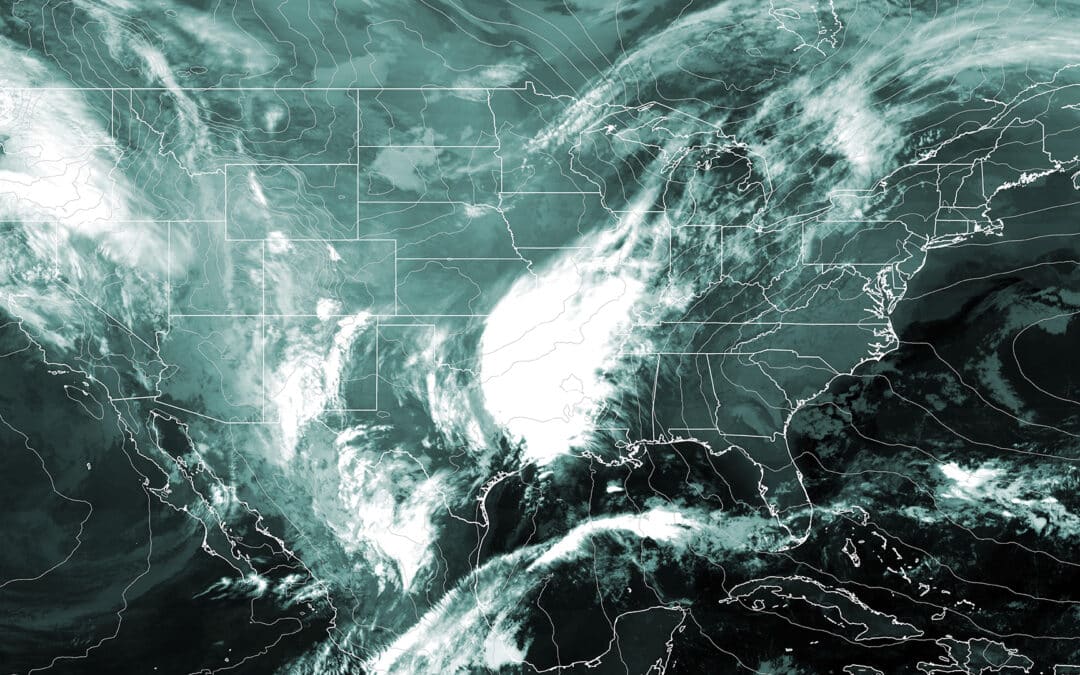

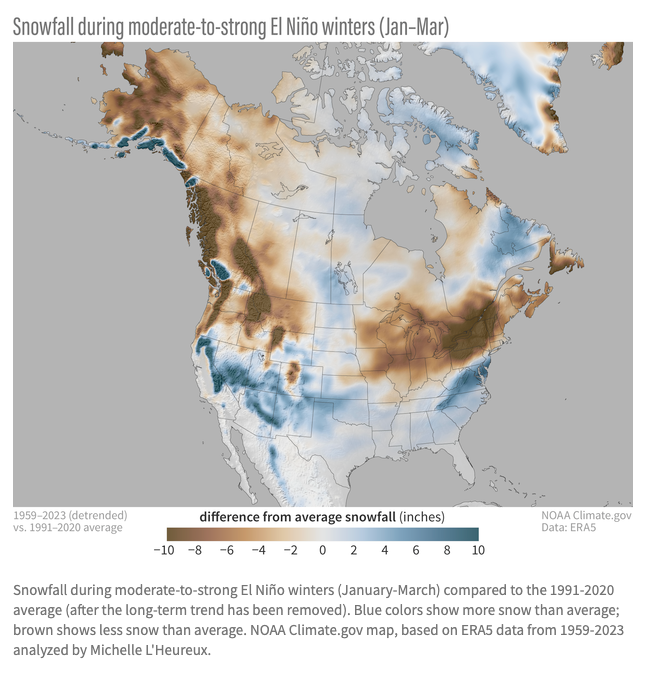

According to the National Oceanic and Atmospheric Administration’s (NOAA) 2023-2024 winter outlook, the first El Niño we’ve seen in four years is heading our way. El Niño typically brings wetter, cooler weather to the south, while also delivering warmer, drier weather to northern states.

This map represents the snowfall variability we can expect from moderate-to-strong El Niño winters — like the one we’re projected to experience in 2023-2024. The blue colors on the map indicate regions of the United States that are likely to see more snow than average, while brown indicates less snow than average. Source: NOAA

This year, states across the south — from the Plains to the Southeast — can expect to see more precipitation than usual. States across the mid-Atlantic and southern New England can also expect more precipitation than usual this year. Depending on temperatures, this precipitation may fall as rain, snow, or both.

While past years give us an idea of what we may expect from an El Niño winter season, no one can say for certain how that will play out in our winter weather forecast. Now is the perfect time for businesses and homeowners — especially those in southern states — to shore up their winter preparedness plans for possible snow, ice, and flooding.

Tips for Insureds

Here are a few winter preparation tips you can share with your clients to help them protect their businesses and properties this winter.

Snow and Ice

During El Niño events, certain areas traditionally not associated with harsh winter conditions may find themselves blanketed in snow and ice. Warmer-than-average sea-surface temperatures in the Pacific can influence the jet stream, causing it to dip southward over parts of North America. This can result in colder temperatures and increased chances of snowfall in regions unaccustomed to such winter extremes.

As we move into the winter months, residents and businesses in states that don’t typically see much snowfall should review their winter-weather safety and preparedness protocols to make sure they aren’t caught off guard.

How insureds can prepare:

- Winterize Building Infrastructures: Ensure proper insulation in attics, walls, and basements to retain heat, minimize the risk of frozen and burst pipes, and prevent ice dams from forming on roofs.

- Proactively Check Heating Systems: Schedule a professional to inspect heating systems to ensure it’s in good working condition for the winter months.

- Create a Snow-Removal Plan: Develop a plan to keep walkways and parking areas clear, ensuring the safety of any residents, employees, and customers. Be sure to remove snow accumulation away from the foundation, basement windows, and downspouts.

- Trim Tree Branches: Remove overhanging tree branches that could potentially break under the weight of ice and cause property damage or injuries.

- Test Backup Power Systems: Ensure that backup power systems, such as generators, are in working order to mitigate the impact of power outages on business operations.

Winter Floods

El Niño tends to enhance the subtropical jet stream, bringing more moisture to certain regions. This excess moisture, combined with warmer temperatures, can result in heavy rainfall and an elevated risk of flooding. Coastal areas and regions with a history of winter storms should be especially vigilant during an El Niño-influenced winter.

While higher levels of precipitation may be a welcome reprieve for states currently in drought conditions, like Texas, Louisiana, Mississippi, and California, it can also increase the risk of winter floods.

Depending on how much water falls and how severe drought conditions were, to begin with, rainfall can quickly turn from much-needed relief to dangerous conditions. If land has been experiencing prolonged drought conditions, the earth can become too dry to soak up heavy rainfall, resulting in flooding.

How insureds can prepare:

-

- Seal Vulnerable Points: Inspect the property thoroughly — including the basement, foundation, windows, and doors — and seal any cracks to prevent water intrusion during heavy rainfall.

- Invest in Sump Pumps: Install sump pumps (or inspect existing ones) to remove water buildup from low points around the property — like in a basement or under a slab. Not only will it help guard against flooding and water damage, it will reduce the risk of mold.

- Evaluate Property Landscaping: Pay attention to the grading around the property and ensure that it sufficiently directs water away from the foundation to reduce the risk of flooding.

- Secure Important Documents and Belongings: Make sure valuable or important belongings aren’t stored on basement floors or other areas that are at risk during a flood. Digitize and secure important business documents, ensuring that backups are stored in a secure, off-site location.

- Create or Update Emergency-Response Plans: After a flood, quick action can reduce the extent of damage to a property. Property owners and managers should have an updated list of contact information for emergency services and restoration companies.

- Invest in Flood Barriers: Consider proactively investing in flood barriers or sandbags that you can place around vulnerable areas of the property if flood risks are high.

Review Insurance Coverage

Securing the right insurance coverage is a key component of any weather preparedness plan. Now is the perfect time for commercial and residential property clients to review their insurance policies to ensure they’re adequately covered for whatever the upcoming winter brings.

At Jencap, we stay on top of the developing trends and emerging risks that impact our agents and their insureds. With Jencap on your side, you can confidently offer your clients insurance solutions and risk mitigation resources that give them peace of mind amidst any storm. Contact us today to speak with one of our expert brokers.