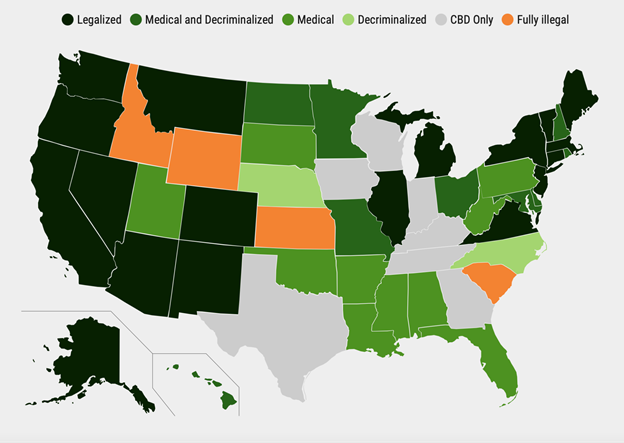

The legalization of cannabis is a hot topic not just among lawmakers and eager hopefuls, but also in the insurance industry. As tolerance and acceptance for cannabis gradually increases, so has its use in the medical community. Medical marijuana usage has grown in popularity in the United States and is now legal in 38 states, 4 U.S. territories, and the District of Columbia. While the FDA hasn’t approved it to treat health problems, many doctors are turning to marijuana to help patients that have been diagnosed with cancer, seizures, PTSD, chronic pain, and more.

With medical marijuana usage on the rise, many states have headed to court to determine if the drug should also be considered a treatment option covered under Workers’ Compensation. Let’s explore current and pending medical marijuana legislation for Workers’ Compensation.

Recent Cannabis Litigation

Medical marijuana hasn’t been considered a treatment option under Workers’ Compensation. However, the concept is gaining traction as a result of recent court cases. In April 2021, in the case of Matter of Quigley v. Village of East Aurora, a New York appellate court ruled that a Workers’ Compensation insurer must reimburse a disabled police officer for his medical marijuana costs. In addition, the state has gone a step further to create a web-based claims portal to help legitimize the drug as medicine and treat it as a prior-authorization medication.

In October 2021, Minnesota‘s state supreme court ruled that in the case of Musta v. Mendota Heights Dental Center et al., employees can’t be reimbursed for medical marijuana for workplace injury recovery because the drug is classified under federal law as a Schedule I controlled substance. Since decriminalization may happen at the federal level in 2022, Minnesota could soon experience different outcomes for these cases.

Similar cases have been heard in Massachusetts, Maine, New Jersey, and New Hampshire in an attempt to legitimize marijuana for medical treatment under the law and insurance. A National Council on Compensation Insurance report found that six states allow reimbursement for medical marijuana, six prohibit it; 14 don’t require insurance repayment but wouldn’t prohibit it either.

Source: DISA

Upcoming Legislation

So far this year, Kansas, Missouri, Nebraska, and South Dakota are amongst the states considering bills that would protect Workers’ Compensation insurers from reimbursing medical marijuana costs. On January 27, 2022, the Mississippi House of Representatives approved a bill to create a statewide cannabis program that would make Workers’ Compensation insurers and self-insured employers exempt from reimbursing or paying for medical marijuana.

In January, Nebraska and South Dakota lawmakers also created a statewide medical marijuana program that would protect insurers and employers from reimbursing injured employees for medical marijuana costs. A recent bill also created a medical marijuana program in Kansas, exempting Workers’ Compensation insurers and self-insured employers from paying for medical marijuana. The bill also includes protections for registered medical marijuana patients who are injured in the workplace.

However, in New Jersey, a lawmaker has proposed a bill that would require Workers’ Compensation insurers to pay for medical marijuana. This comes on the heels of the New Jersey Supreme Court’s ruling in the case of Hager v. M&K Construction, where the employer and its Worker’s Compensation insurer must reimburse an injured worker for medical marijuana expenses. In this case, Hager suffered an injury on the job in 2001 that required surgery. He relied on opioids for chronic pain. Years later, he entered a New Jersey medical marijuana program to overcome opioid addiction and shift to medical marijuana use for pain treatment. Medical marijuana costs were more than $600 a month, and now his employer will be required to reimburse him for ongoing expenses.

Changes to Expect in Cannabis Coverage

New York-based lawyer, Jeremy Buchalski, predicts that the costs of Workers’ Compensation claims will decrease as more states legalize recreational marijuana. This is based on findings from the National Bureau of Economic Research that the propensity to receive Workers’ Compensation benefits, along with the benefit amount, declined due to recreational marijuana law adoption. Buchalski also believes that injured workers who rely on medical marijuana may no longer require costly pain management treatments. However, he still expects legal disputes over medical marijuana Workers’ Compensation coverage to continue for years to come.

With over 60 monoline markets, industry-leading expertise, and national reach, Jencap’s expert brokers are ready to navigate your clients’ unique Workers’ Compensation needs. Contact us today to get started.