The property insurance market in North America has seen staggering price increases of 20-30%. Understandably, policyholders want to know why.

There isn’t a single, straightforward answer, unfortunately. The rise in prices is due to a “perfect storm” of factors, including things like the recent uptick in natural disasters, inflation, supply chain disruptions, overdue valuation adjustments, rising claims costs, and the reinsurance market.

The reinsurance market has a profound impact on property insurance pricing, but this isn’t something the average policyholder typically knows much about. In this blog post we’ll break down how reinsurance works and how current reinsurance trends are reflected back in what we’re seeing throughout the rest of the insurance market, particularly when it comes to current property insurance price hikes.

But first … what is reinsurance?

Reinsurance is an insurance policy for insurance companies. Its goal is to protect insurance companies by managing their overall exposure to loss. Reinsurance works by transferring a portion of the risk assumed by an insurance company to another insurer (the reinsurer), who agrees to pay a portion of claims arising from that risk.

Insurance companies take on risk by selling insurance policies to individuals and businesses. They make money by charging premiums that total up to greater than their combined losses from paying out claims. However, if the insurance company is on the hook to cover claims from a major catastrophic event, for example (or a chain of catastrophic events like we’ve seen recently), they can quickly drain their cash reserves. Without those reserves, they can’t pay out any more claims or stay in business.

This is where reinsurance comes in. Primary insurers purchase reinsurance as a buffer to cover large, unexpected losses that they may not want to handle on their own.

How does reinsurance impact the average policyholder?

Just like a business or individual has to renew their insurance policies every year, insurance companies have to renew their reinsurance policies. When those policies go up for renewal, reinsurance companies assess their profits and losses then make changes to what they’ll offer and how much they’ll charge in the following renewal term. This can have a significant impact on the overall insurance market, affecting both insurers and policyholders alike.

Insurance companies must take into account how much they pay for reinsurance when pricing their policies to businesses and individuals. If reinsurance becomes more expensive or harder to get, insurers may be forced to increase prices for their policies. This can result in higher premiums for policyholders.

Reinsurance can also impact the amount of risk that insurers are willing to take on with their policyholders. If reinsurance is widely available and affordable, insurers may be more willing to take on higher-risk policies because they know that they can transfer a portion of the risk to a reinsurer.

What does this have to do with rising property insurance rates?

The pricing and contract term negotiations that take place during renewal periods gives us important signals and information about trends in the overall insurance market. This year, the January 1 renewal period revealed a great deal about what’s going on in the reinsurance market and the downstream impact it has on the rest of the insurance market — particularly when it comes to property insurance.

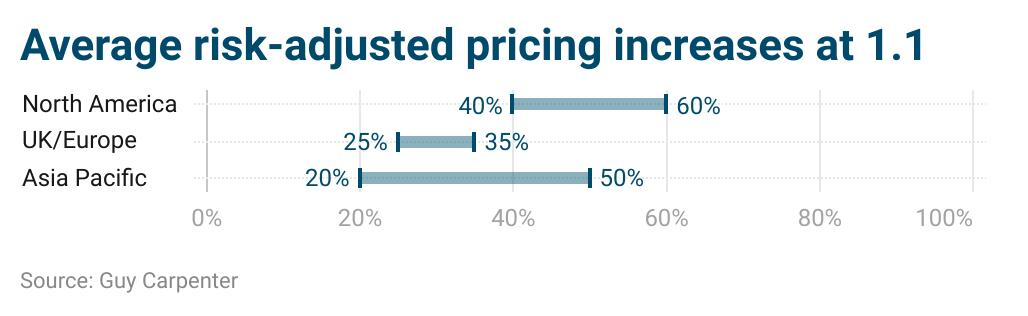

The reinsurance property insurance market in North America has seen an average price increase of 40-60%. Since carriers are paying more for their reinsurance, they’re, in turn, passing some of those increased costs on to insureds.

Bottom line: All carriers are responding by increasing their rates — especially for properties that are at higher risk for catastrophic events.

In the January 2023 reinsurance renewal period, property insurance pricing increased world-wide. (Source)

How does it impact policyholders?

The increase in property insurance pricing has significant implications for the insured. Policyholders can expect to pay higher premiums for their coverage, particularly if they live in areas that are prone to natural disasters. In addition, insurers may become more selective in the risks they are willing to take on, potentially limiting coverage options.

According to Meryl Steinzor, Jencap Vice President and property specialist, “At Jencap, we’re seeing several carriers pushing for 25% rate increases, as a starting point. Properties that are deemed higher risk — such as policies that have had losses in the past or properties located in Florida — can expect to see even higher rate increases.”

Understandably, many insureds are left feeling like their hands are tied, since there’s little they can do to shift the impact that things like inflation, supply chain issues, or natural catastrophes have on the insurance market. They can, however, seek out ways to look as attractive as possible to underwriters, such as highlighting how they’ll minimize loss in the event of a major disaster.

Jencap is your wholesale partner in property insurance.

As a leading wholesale broker, Jencap works with our retail agent partners to find the best coverage available for your clients, even in a hard market.

When sending in a new property submission or renewal application, please include information about any changes in exposure and loss history, as well as an up-to-date Excel Statement of Values (SOV). Depending on the risk, our brokers like to begin the renewal process 90 to 120 days prior to expiration, which gives us an opportunity to submit to the markets and review what’s currently offered across different insurance carriers.

Contact Jencap to speak to one of our property insurance experts today.