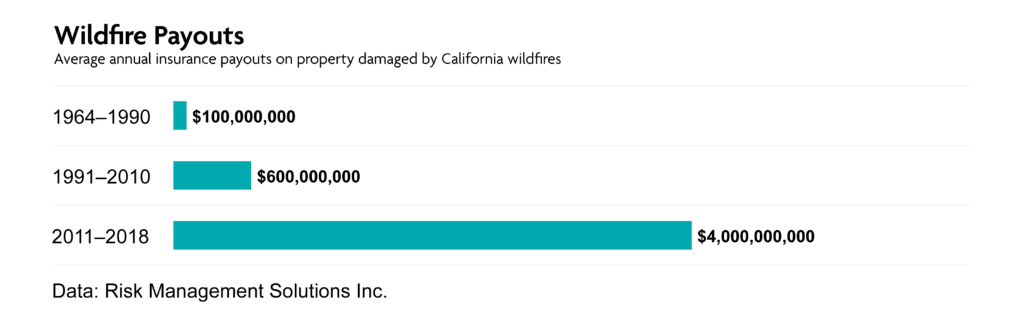

An average of 70,000 wildfires are set ablaze across the United States each year. What’s even more steep is the rapid growth trend of the average insurance payout when a wildfire occurs. Take California for example: between the years of 1964 and 1990, the average wildfire cost less than $100 million. That payout amount increased to about $600 million each year from 1990-2010. From 2011 to 2018, the average wildfire payout amount rose to a staggering $4 billion per year and continues to rise.

Kris Bauer, Jencap Western Region President, explains that the result of this upward trend is rising premiums and a decrease in capacity for wildfire coverage. “For anything that’s catastrophically exposed—from a property or liability perspective—retailers have to prepare their clients that the premium for those things, in the near term, is going to be elevated.”

Impacts to Property Insurance

Both residential and commercial property owners are feeling the burn to their pocketbooks when it comes to paying for property insurance. According to risk management company Verisk, over 4.8 million properties are at high or extreme risk of wildfire nationwide. No surprise, properties in more wildfire-prone areas pay more for coverage and are more likely to see wildfire policy exclusions or drops in coverage, as carriers try to manage risk.

The number of properties within wildfire-prone areas is also increasing, thanks to urban creep, particularly in California. As major cities reach their capacity and become too expensive to live in, new development continues further away from the city center, closer to wildlife and brush. Research published in the journal of Land Use Policy estimates that over the next 30 years, California will build 645,000 new homes in areas highly prone to wildfire.

Impacts to Liability Insurance

Fire is unique from other catastrophic events, because although there are some purely environmental factors that increase the likelihood of a fire catching and spreading—like extreme heat and drought—90% of fires are started by people. In other words, there’s often someone who can shoulder blame.

Let’s consider, for example, a business responsible for clearing brush and trees. One of their trucks backfires, and a spark ignites some brush, which quickly spreads and causes acres of damage. Although the fire wasn’t intentional, the business is found at fault and their liability insurance has to cover the cost of the damages (up to the policy limit only).

Those liability claims can add up to far more than what carriers anticipated when they originally underwrote that risk. As a result, Bauer says, “Liability insurers are looking closer at risks that might have exposure to increasing wildfire prevalence. So now you’re seeing liability policies with wildfire exclusions.”

Contractors, especially, can expect to see the impacts of wildfire on third-party liability insurance going forward. This includes, for instance, building, utilities, and security contractors, as well as management companies. Why? These types of businesses are exposed to the most risk—either working in more remote areas or contractually responsible for the property of others.

Wildfire Risk Mitigation

Given that insurance pricing and coverage is tied so closely to risk, one thing insureds can do is mitigate and manage their risk as much as possible. The Insurance Institute for Business & Home Safety (IBHS) publishes guidelines that equip both residential and commercial owners with information to better prepare properties to prevent and withstand wildfire spread. As IBHS states on their website, “When put into action by homeowners, business owners, and ultimately whole communities, the risk curve can be bent downward and limit the catastrophic reach of wildfires.” IBHS’s recommendations include things such as:

- Installing fire-resistant Class A rated roofs

- Regularly clearing leaves and debris from gutters

- Replacing and upgrading exterior vent screens to prevent wildfire embers from easily spreading into buildings

- Keeping a perimeter of 5 feet around buildings that’s clear of any debris or easily ignitable materials like dead foliage

Setting Expectations for the Years Ahead

The insurance industry is being crunched for capacity. And for some carriers, that risk is just too great, prompting them to limit and exclude coverage for wildfire altogether. Rates are high, but Bauer is optimistic that they’ll plateau. “Carriers are starting to see there’s some adequacy in the rates and in the limits they’ve deployed. New companies are coming in to fill gaps—and that’s good news.”

Jencap specializes in hard-to-place risks, including wildfire-exposed residential and business properties. We understand the unique complexities that exist for this exposure and are your trusted source to provide your clients with the best coverage available. Contact us to learn more.