Climate change has been making headlines recently, and now experts predict that global warming will lead to substantial sea level rise in the coming years. In fact, scientists are forecasting a one-foot rise in sea level over the next 30 years.

To put this into perspective, government agencies including NASA, NOAA, and USGS, anticipate that the rise in ocean height over the next three decades could equal the total rise we’ve experienced over the past 100 years. As a result, coastal flooding will increase at an alarming rate, endangering many communities. To make matters worse, if greenhouse gas emissions continue to rise, global temperatures will also increase, causing sea level rise to exceed the current projections. Jencap’s experts are focused on how these environmental trends could impact the insurance industry.

Impact on Property

Sea level rise will affect our industry in many ways, with flooding being a primary concern. Increased flooding events will lead to more property claims and exposures, along with property insurance price hikes. Flooding will have the most significant impact on coastal properties, including homes and businesses. Florida leads the U.S. with the most cities – and homes – at risk for flooding, but other coastal states, including Louisiana, Maryland, New Jersey, and North Carolina are also at high risk.

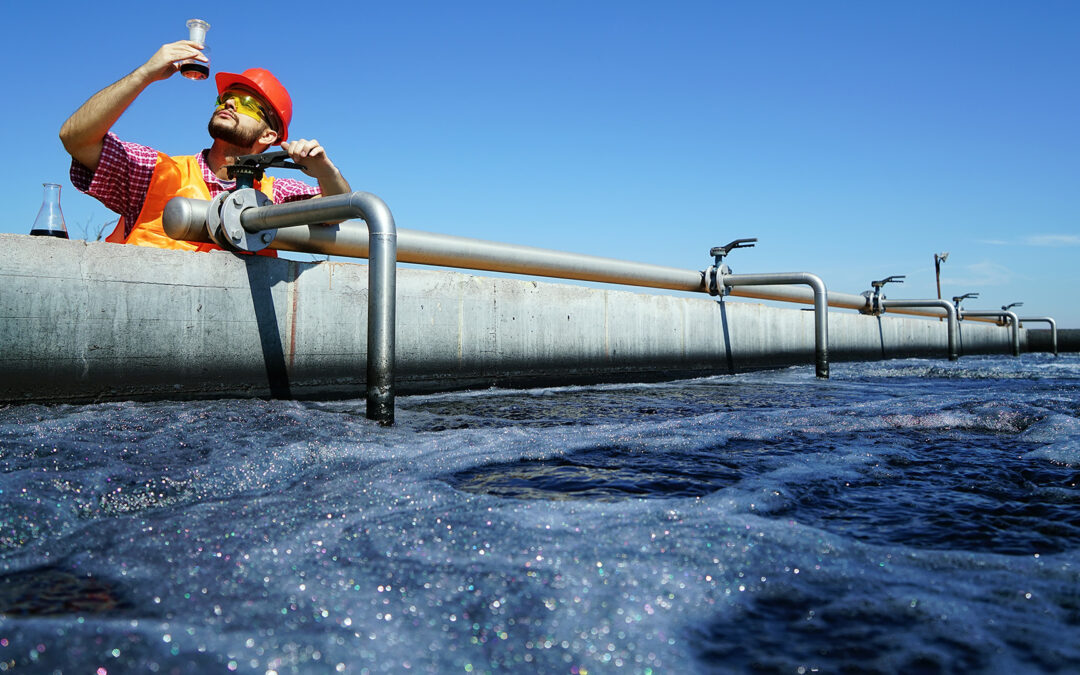

Environmental Coverage

Environmental liability exposures are expected to increase because of more coastal flooding. When floods inundate properties with water, contamination migrates throughout an area or into a waterway. Flooding also leads to saltwater intrusion, which can result in contaminating potable water aquifers in cities along the Atlantic and Pacific coasts.

The outcomes are endless for the environmental impact caused by climate change and related factors, like sea level rise, which could easily be an exponential climate change factor within the next few decades. The potential impact to site pollution policies, in particular, will be significant and, yet, this risk is not commonly factored into the underwriting of Pollution Liability policies.

The National Oceanic and Atmospheric Administration (NOAA) uses a Global Forecast System (GFS) weather model to forecast weather events, as well as predict ocean waves and levels caused by atmospheric events. There are many ways that the NOAA model could apply to environmental exposures, including:

- Existing sites undergoing cleanup are now under water.

- Flooding introduces contaminants into third-party properties.

- Flooding of UST systems.

- Saltwater intrusion for potable water.

- Flooding damages buildings and infrastructure.

- Soil, silt, and sedimentation from construction sites (an especially big risk in California due to new construction permits on projects over one acre in area).

- Trespass from adjacent sites, and more.

To determine your clients’ property and environmental insurance needs, you’ll not only have to assess and account for their risk exposure today, but plan for the future. Global warming and sea level rise are legitimate concerns and our specialized Jencap brokers are staying on top of the trends every step of the way. Contact us to learn about our property and environmental insurance capabilities.