The past eighteen months has been a “whirlwind” for the Florida condo market. Just over a year ago, the Surfside Champlain Towers South condo outside of Miami Beach collapsed. This October we saw the devastating effects of Hurricane Ian, which pummeled the Florida coast, costing estimated losses of up to $57 billion. These two major events, in combination with several other factors, have created a seismic shift in the Florida condo insurance market.

Capacity is shrinking across the entire property insurance market, making reasonably priced coverage hard to come by. Florida condo properties, in particular, are proving the most difficult to place. Many condo associations can expect sharp premium increases in their upcoming renewals that exceed two to three hundred percent, while others may find themselves scrambling to find coverage after their existing carriers refuse to renew. Older construction—often built with joisted-masonry and wooden roofs—will find securing reasonable insurance coverage particularly challenging.

We’ll dig into some of the reasons why Florida condo owners are seeing the rise in rates and what policyholders can expect during the coverage application and renewal process.

What’s Shaking Up the Florida Condo Insurance Market?

- The Surfside Champlain Towers Condo Collapse. The 2021 condo collapse prompted many carriers to more carefully scrutinize condo risk exposure. Since the collapse, multiple carriers have pulled out of the Florida condo market entirely, significantly reducing capacity. Great American, the lead carrier for Champlain Towers, was one of the biggest carriers affected, and their exit has had significant ramifications for condo owners. Great American wrote the majority of X-Wind business in Florida, and since they pulled out, X-wind rates have doubled.

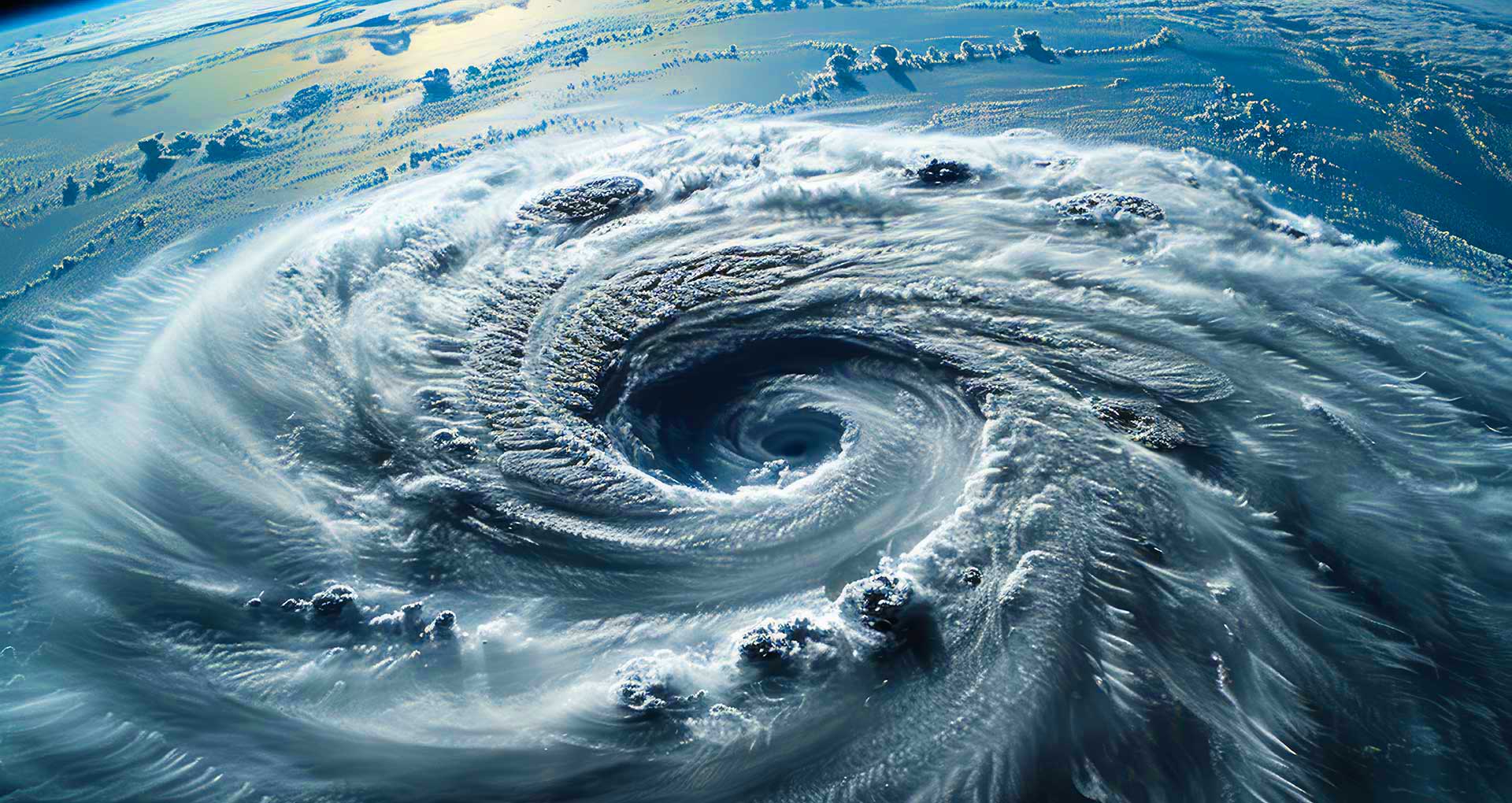

- Hurricane Ian. The Florida property market was already on shaky ground leading up to Hurricane Ian, but the Category 4 storm made things even worse. In the wake of the Surfside Condo collapse, there were still some carriers willing to take on property risks. But after Ian, most of those remaining carriers have also pulled out, making condo coverage nearly impossible to find. What little capacity is available will come with high rates, high deductibles, and restrictive terms.

- Unpredictable Catastrophic Weather Events. Ian is just the most recent in a string of unprecedented and devastating weather events. It’s no secret that global climate change is having a profound effect on the insurance industry. The compounding losses from a chain of unprecedented weather events are driving up rates and reducing capacity across property insurance markets nationwide.

Last year alone, there were three particularly catastrophic weather events that created significant damage and racked up insured property losses:

- Winter Storm Uri sent a polar chill across multiple states, resulting in winter weather alerts that affected more than 170 million Americans. Freezing temperatures knocked out the Texas power grid, creating the largest power outage in the U.S. in over two decades.

-

-

- Hurricane Ida ripped through Louisiana before traveling up the coast, causing tornadoes and flash flooding across multiple states. Total losses from this Category 4 hurricane are estimated at $26 billion.

-

- 34 tornadoes ripped through eight states over the course of just two days, making it the largest and most costly string of tornado events in the U.S.

- Carriers Are Using New CAT Models. Historical catastrophe (CAT) modeling is evolving in response to the increasing risks of climate-related weather events. The growing accuracy of these models offers a sobering reality check that points to an increase in both average annual loss and probable maximum loss—neither of which are favorable to policyholders.

- Challenges with Building Valuations. Insurers and policyholders alike are realizing that commercial properties, especially condos, have been severely undervalued. This means that the cost to replace or repair damaged or destroyed properties often greatly surpasses the value assigned at their last appraisal. Carriers are requiring updated valuations during policy renewals to ensure they can accurately assess risk. Unfortunately, these valuation “corrections” often translate to higher premiums, lower limits, and, in some cases, drops in coverage.

- Inflation and Supply-Chain Issues. Prices are sky high across the construction industry, due in part to rising inflation and supply-chain challenges. This impacts everything from lumber and other building materials to equipment and labor. By the end of this year, construction costs are expected to hit a 14.1 percent year-over-year increase. Higher material and labor costs mean higher costs to replace or repair after loss—and higher insurance premiums follow.

On their own, any of these factors would impact the property insurance market, but the combined effect is undeniably profound. Put simply, we’re seeing more frequent damage (thanks to an increase in weather events) to properties that have been historically undervalued, and the cost to repair or rebuild after damage is rising (thanks to inflation and supply-chain issues).

All of that translates to greater risk for insurance carriers who are trying to ensure they have the adequate funds to cover claims, while also protecting their own bottom line. Unless the trend of weather-related catastrophes slows down or new carriers enter the market and open up additional capacity, we can expect this hard condo market to be the new normal.