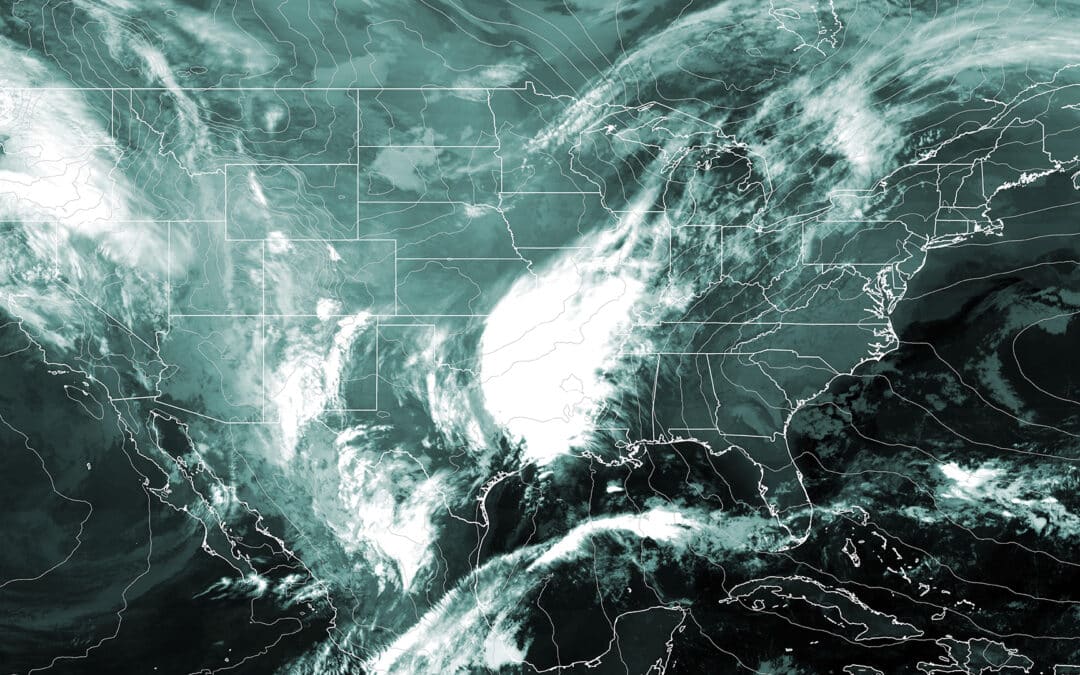

Natural catastrophes broke insurance claims records in 2021.

Historically, primary perils – like earthquakes – have been weather events with the highest loss potentials, but secondary perils – including wildfires, rainstorms, and floods – have become more frequent in recent years and are responsible for a growing share of insurance claims. Secondary perils are small to mid-sized events and often follow a primary peril, such as hurricane-induced flooding or a fire following an earthquake. The increased frequency of secondary peril events is generating significantly more insurance losses, and losses from secondary perils now often meet or exceed losses from primary peril events.

The number of weather-related disasters has increased 5x over the last 50 years, due in large part to climate change consequences, such as sea level rise, warmer temperatures, and more extreme weather. Trends – such as population growth in high-risk geographies – are also leading to more property damage and insurance claims from secondary perils.

Consider Hurricane Ida, one of the most expensive U.S. hurricanes on record, costing insurance companies an estimated $30.3 to $42.5 billion in claims. This storm caused wind and storm surge losses in the Gulf of Mexico, as well as rain-induced flooding from the Gulf to the Ohio Valley, mid-Atlantic and Northeast. There was tremendous and widespread residential, commercial, automobile, and watercraft property damage as a result of this storm. Additionally, strong winds damaged power lines, causing prolonged power outages – and business interruption – along the storm’s path. To make matters worse, Hurricane Ida occurred during the COVID-19 pandemic, amid supply chain disruptions, increased construction and materials costs, and labor shortages, causing greater delays, costs, and hassles during recovery efforts.

Other record-breaking natural catastrophes in 2021 included winter storm Uri in Texas, which caused widespread blackouts and extensive damage totaling $196.5 billion, making it the most expensive winter storm on record. The prolonged freezing temperatures and power outages resulted in extensive property damage from freezing pipes, fallen tree limbs, and the weight of ice, sleet, and snow. More than 456,500 insurance claims were filed because of this storm.

Although secondary peril events happen globally, the US experiences more related insurance losses and damages than anywhere else in the world. Population growth in coastal areas and other catastrophe-prone regions, such as wildfire-prone Colorado, has also increased the severity and expense of these insurance claims.

Losses stemming from 2021’s natural disasters are expected to exceed the ten-year average, continuing a trend of 5-6% annual increases in catastrophe losses. In fact, it has become common for one secondary peril event, such as a wildfire, storm, or flood, to cause losses that exceed $10 billion. Since these events may occur in heavily populated areas, such as Hurricane Ida’s damage in New Orleans, secondary perils have become a major threat for homeowners and business owners alike.

Several insurance companies have exceeded their catastrophe budgets for the last decade by an average of 31%. Therefore, it’s critical for them to understand the associated risk factors and apply the appropriate rates by line of business to better achieve their profit targets.

The global climate change impact and associated weather-related trends impact every single facet of the insurance industry. Jencap’s specialized brokers have in-depth knowledge on not just the landscape of the marketplace today, but always have their eye on the future to partner with you and your clients’ and plan accordingly. Contact Jencap to properly protect your clients’ most valued assets today.