The shipping industry is fraught with risks and exposures — volatile weather conditions, mechanical breakdowns, theft and piracy, fuel spills, cyberattacks, and supply chain disruptions, just to name a few. One risk in particular, however, is drawing a lot of attention from insurance professionals recently: container ship fires.

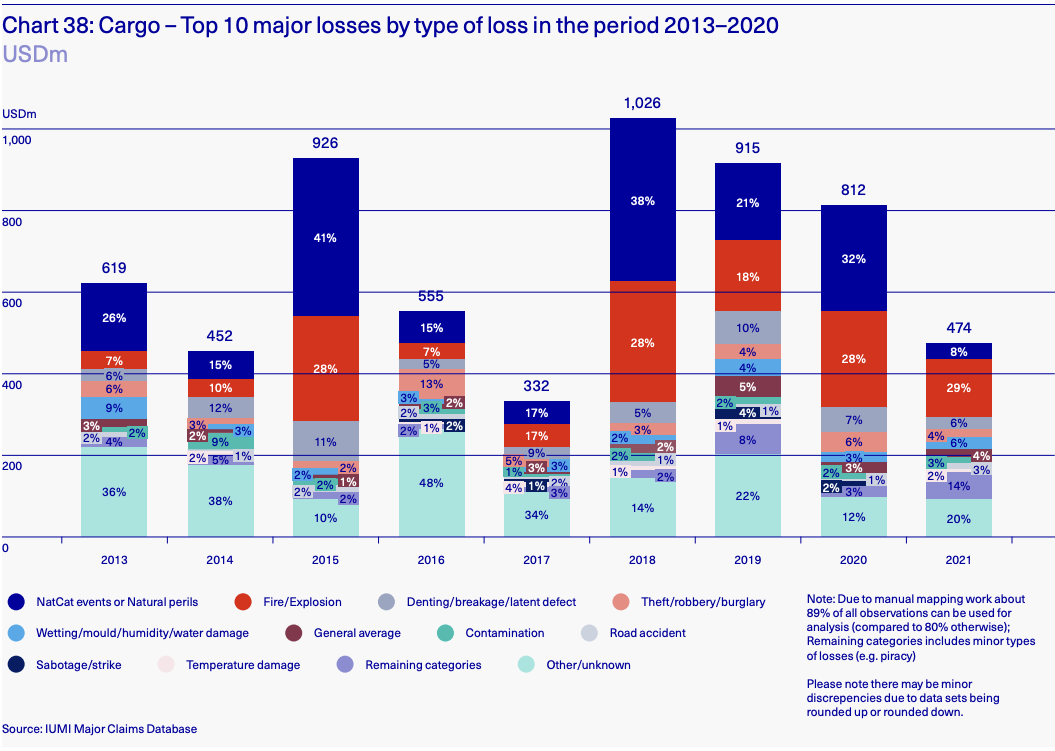

According to a 2022 report by the International Union of Marine Insurance (IUMI), cargo fires on shipping vessels have become an increasingly common issue and are responsible for numerous deaths and substantial damage. The report goes on to explain that fires/explosions are the second leading cause of major losses (following natural catastrophe events).

Source: IUMI Major Claims Database, reprinted in the IUMI’s 2022 Analysis of the Global Marine Insurance Market report.

Insurance Business Magazine recently published insights from an interview with Hendrike Khül, Policy Director of the IUMI, delving into the trending issue of container ship fires. In the interview, Khül explains several reasons why container ship fires have become such a top-of-mind problem for marine insurers:

- Vessel sizes and load sizes have grown. Container ships today carry as much as 1500% more containers than they did 60 years ago. Dangerous and combustible items — like chemicals or lithium-ion batteries — are often the source of ship fires. The larger the vessel, the easier it is to hide or misdeclare these items in hopes of sneaking them past inspections.

- On-board fire safety rules and firefighting systems haven’t kept up with the growing risk. The shipping industry needs better automated tools and systems for detecting fires earlier and fighting them. Although ship crew members aren’t trained firefighters, when a ship catches fire at sea, the crew members are often the only ones around to combat it. Ideally, ships should be equipped with automated tools like water curtains and water monitors to alleviate some of this responsibility from the crew.

- Container ship risk management practices are outdated. The marine insurance space is lagging behind other markets when it comes to implementing digital technology and artificial intelligence. There’s a need for more robust digital solutions to help marine insurers get a more complete and accurate view of an individual ship’s risks.

Read the full Insurance Business Magazine article for more details.

Jencap’s team of ocean and inland marine brokers work alongside you to find the coverage your clients need — both at sea and on land. Contact us to learn more about Jencap’s marine insurance solutions and get a quote today.