The Infrastructure Investment and Jobs Act (IIJA) marks one of the most significant physical infrastructure investments in the U.S. in more than five decades. Over the past 18 months, it has led to an increase in projects and jobs across multiple industries. As federal funding continues to flow over the next several years, the insurance industry needs to remain prepared and ready to provide appropriate policy coverage for these new and growing projects.

What Is the Infrastructure Investment and Jobs Act?

In November 2021, Congress passed the IIJA, a bipartisan infrastructure bill, which allocated $1.2 trillion in government spending for transportation and infrastructure. Of that amount, $550 billion was specifically earmarked for new investments and programs.

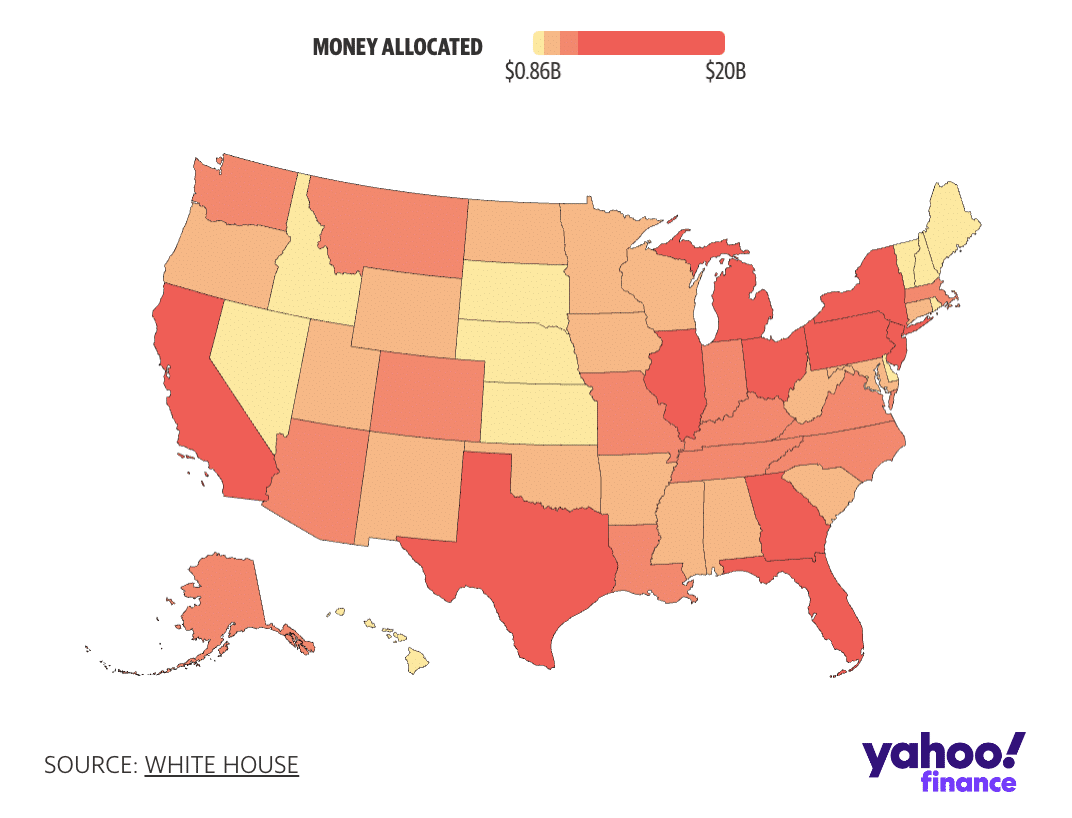

The two largest buckets of funding are allocated to transportation projects and energy investments. But significant funding is also designated to expanding and improving broadband access, water infrastructure, environmental resilience, waterways, ports, airports, and more. The amount of money allocated to states for this effort varies, with more populated states (California, Texas, New York, Florida, and Illinois) receiving the most funding.

Source: Data provided by the White House and visualization created by Yahoo! Finance.

Here are just a few highlights from the White House on what the IIJA has accomplished across the nation thus far:

- $185 billion in total funding announced

- Initiated repair or replacement of over 3,700 bridges

- Repaired over 69,000 miles of road

- Awarded funds for more than 3,000 new clean transit and school buses

- Increased enrollment in the Affordable Connectivity Program to over 16 million households

- Approved state plans for water funding, EV charging networks, and high-speed internet

What Does the IIJA Mean for Businesses?

No doubt, the IIJA offers the opportunity for construction and related businesses across multiple sectors to access additional capital for infrastructure projects. However, this opportunity is not without its challenges.

At the beginning of 2022, the engineering and construction industry held a positive business outlook. This was in part due to IIJA and its impact on the non-residential segment. Now, midway through 2023, the industry isn’t looking as favorable as previously hoped. Even with funding, the construction industry must still overcome extreme labor shortages, soaring inflation, and shaky supply chains. In addition, in order to qualify for IIJA funds, contractors also need to meet certain criteria — for instance, specific security clearances, cybersecurity requirements, and DEI requirements.

Nevertheless, IIJA will offer an economic boost to the industry over the next five years, particularly the non-residential segment. Savvy businesses across a multitude of sectors will be poised to seize the opportunity.

What Does This Mean for the Insurance Industry?

Over the next five years, IIJA aims to create many new projects that will all require various types of insurance coverage — including general liability, excess liability, workers’ compensation, transportation, and more.

That said, insurance rates are on the rise across a number of markets. In order for businesses to secure the best coverage at the best rates, they will need to demonstrate that they’re taking every possible precaution to ensure safe, profitable projects. Insurers will want assurances that businesses are preparing and training their workers well, maintaining high worksite safety standards, and appropriately mitigating risks. Many construction insurers, for example, are boosting loss-control activities and requiring their clients to employ electronic surveillance at construction sites, use fire retardants on wood-frame projects, or install water-damage mitigation systems, among other risk-mitigation measures.

Jencap: Your Insurance Resource

With large infrastructure projects, there’s no one-size-fits-all approach to risk management and insurance protection. Projects of this size and scale (and their associated risks) can be incredibly complex and require an intricate orchestration of coverage solutions, including contractor- and owner-controlled insurance programs, bonds, and other forms of project protection (like Project Completion Insurance). Jencap brokers have nationwide experience working across every risk type and account size and understand the unique insurance implications of the IIJA. Put Jencap to work for you by contacting us today.