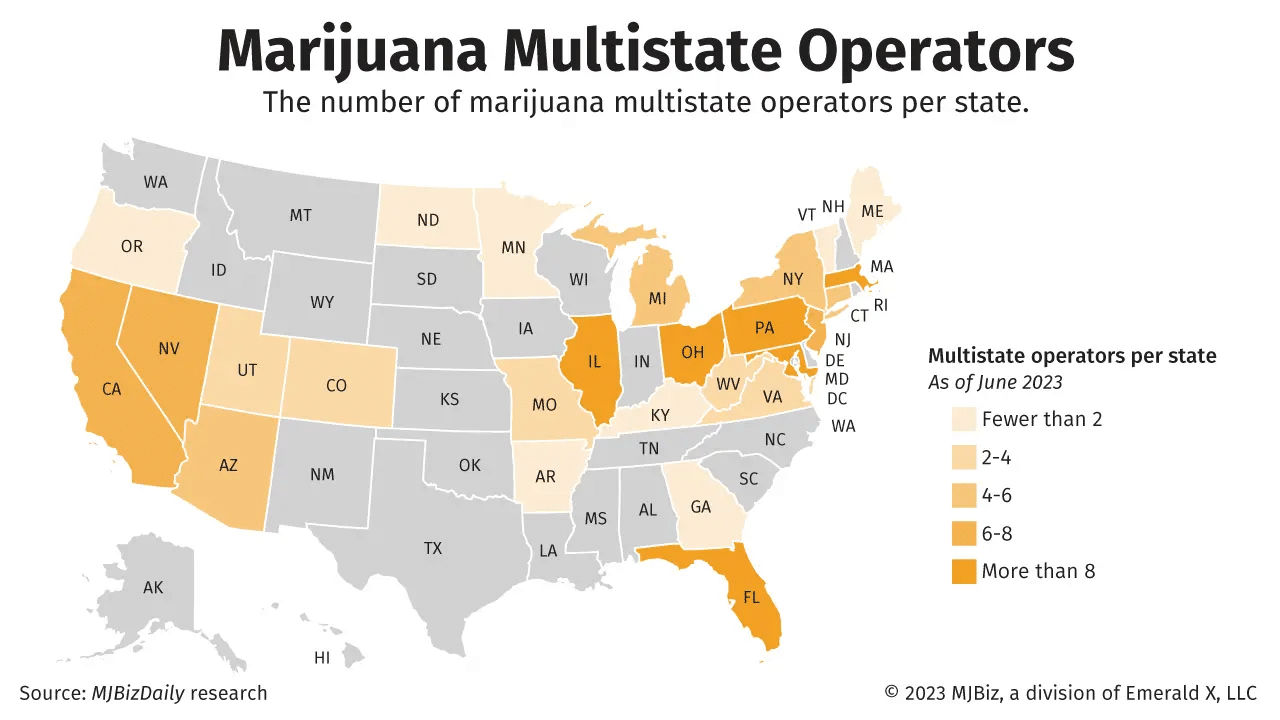

Multistate operators (MSOs) are the heavy-hitters of the cannabis industry. These are established, well-funded players who set their sights on expanding into as many new markets and states as possible — a feat that’s not easily accomplished in the heavily regulated world of cannabis. While expansion and growth is often a marker of success for any business owner, for MSOs, cross-state expansion also means exponentially more complexity, risk, and expense.

For some MSOs, recent financial pressures are intensifying and forcing them to take drastic measures to protect their business, including issuing layoffs and exiting key markets. In this volatile environment, MSOs need confidence that every dollar they spend directly benefits the business. While budget cuts will likely abound in the coming months and years, one line item MSOs can’t do without is insurance, but they’ll need the support of savvy insurance professionals who know how to make sure their money is spent on the policies that serve them best.

What Exactly Is an MSO?

An MSO is a cannabis company that conducts business in more than one state where marijuana is legal for medical or recreational use. These companies, some of which are very large and publicly traded, have the unique advantage of expanding their operations across state lines, capitalizing on the growing cannabis market.

MSOs are often fully integrated across the supply chain, meaning that their operations might include cultivation, processing, distribution, and retail. This allows them to produce and sell a wide range of cannabis products and gain strong brand recognition in multiple states.

Although these operations benefit from economies of scale, branding consistency, and market diversification, they must navigate a great deal of operational complexity, since cannabis is still illegal on the federal level and local legislation varies from state to state.

MSOs Face Immense Financial Pressure

All cannabis businesses — from small mom ‘n’ pop shops to expansive MSOs — are forced to maneuver through a tangle of challenges to survive; including shifting regulations, funding difficulties, and ever-changing consumer preferences, just to name a few. However, given their size and scale, these problems can grow exponentially larger for MSOs, resulting in financial pressures that threaten business viability:

- Large, complex operations translate to high operational costs. When it comes to cannabis, business practices don’t follow the same rules and best practices compared to traditional businesses. Because cannabis is still federally illegal, commerce across state lines is prohibited. A cannabis cultivator and manufacturer in Oregon, for instance, cannot load their product up, drive it across the border, and sell it in Washington.

MSOs work around this challenge by opening legally-distinct business entities in different states. This enables them to produce or sell products in more than one state while still using the same brand name. However, each state has its own regulations and restrictions for producing, testing, packaging, and selling. These hurdles make it tricky for a MSO to streamline and standardize their business processes across all their operations, which is highly inefficient and costly to manage. - Securing adequate funding is difficult. Until cannabis is legalized on the federal level, banks and traditional investors will remain reluctant to offer funding. In the meantime, the cannabis industry hoped the SAFE Banking Act would pass and provide protection to federally regulated financial institutions that offer services to cannabis businesses in legal states. Legislative progress has been slow, however, leaving few alternatives to cannabis business in need of capital. In the past, some MSOs were successful in raising capital through private equity, but that funding has started to dry up as well. Without the necessary cash infusions to keep operations running, some MSOs will find their business viability at risk.

That all may change, however, given the recent news that cannabis may be rescheduled from a Schedule I to a Schedule III controlled substance.

- Inflation is driving up the cost of business operations. Inflation has impacted all industries, and cannabis is no different. Like in many other businesses, rising inflation has increased business costs across the board. But, unlike more traditional businesses, cannabis business expenses do not qualify for tax deductions — so the increased costs are felt even more acutely. If the recent recommendation to reschedule cannabis to a Schedule III controlled substance go through, cannabis operations can expect, at the very least, some relief when it comes to taxes.

- An oversupply of cannabis products in some markets is driving prices down and hampering profitability. Although prices for other consumer goods are soaring in this inflationary environment, cannabis prices in some states — like Michigan and Oregon — are actually falling. Many states with cramped markets are seeing a similar problem: there are too many businesses, producing too much product, without enough demand. And because it’s illegal to sell cannabis products across state lines, there’s no way to move this excess capacity, leaving businesses with no option but to dump prices in order to remain competitive and sell product.

Specialty Cannabis Insurers

The complexity of a MSO’s business operations extends to insurance as well. Someone managing multiple business entities in different states is going to contend with a very broad range of local legislation and business risks. This can make it very easy for a cannabis MSO to find themselves overpaying for cannabis business insurance coverage that has gaps or isn’t providing value.

Erich Schutz, Jencap National Cannabis Practice Leader explains that by working with a cannabis insurance professional who specializes in the unique needs and challenges of MSOs, you can avoid paying for insurance that isn’t serving the business. “MSOs are under tremendous expense pressure,” says Schutz. “Every dollar counts. Partnering with a specialist that knows this industry inside out gives you the confidence that you’re insured adequately and not overpaying for something you’re not using.”

MSOs have more robust insurance needs than a single-state operation, and a generic insurance program just won’t cut it. Jencap’s cannabis team not only has the experience and industry expertise needed to determine what MSOs in different states need, they also have access to the carriers who can provide that coverage.

No one knows what the future of cannabis might hold. But by working with insurance experts who keep up with current industry trends (like the possibility for cannabis rescheduling) and emerging risks, you can trust you’ll be prepared to navigate whatever challenges lie ahead. Contact us today to learn more.