They were designed to make life easier. Think slippery frying pans, water-resistant jackets, and fire-suppressing foam. Now they’re one of the biggest liability landmines in the insurance industry.

We’re talking about PFAS: per- and polyfluoroalkyl substances. The so-called “forever chemicals” that don’t break down, don’t go away, and don’t stay put. In Part 1 of this series, we covered where PFAS show up and why regulators are taking notice. Here in Part 2, we’re exploring what that means for PFAS insurance: where coverage fails, how liability spreads, and what agents need to watch.

PFAS Is No Longer a Surprise. It’s a Known Exposure.

For years, PFAS flew under the radar. Not anymore. Today, it’s the focal point of billion-dollar lawsuits, emergency EPA rulemaking, and intense state-level PFAS regulations. It’s triggering scrutiny during Phase I Environmental Site Assessments (ESAs), contaminating groundwater near fire training facilities, and showing up in the packaging of everyday consumer goods.

And insurers? They’ve taken notice. They’re bracing for “the next asbestos,” and this could be it.

Increased awareness has brought increased exclusions. Many general liability, property, and umbrella policies now contain broad pollution exclusions that specifically bar PFAS-related claims. In other words, if your client’s facing cleanup costs, third-party injury allegations, or regulatory enforcement tied to PFAS, there’s a good chance their standard policy won’t respond.

So, What’s an Agent To Do?

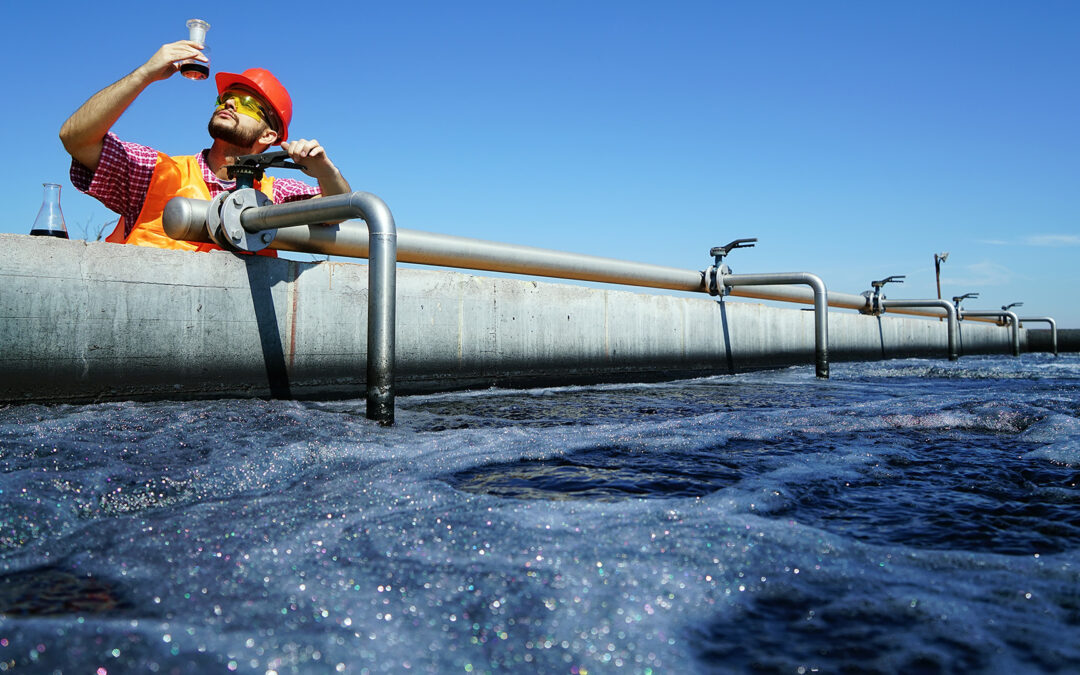

When PFAS is present, it’s a chemical issue and a coverage architecture issue. Standard coverage forms simply weren’t designed for the scale, spread, or persistence of PFAS risks. That’s where specialized environmental insurance comes in:

- Contractors Pollution Liability (CPL) – essential for anyone disturbing soil, groundwater, or older infrastructure that may harbor contamination.

- Site Pollution Legal Liability (PLL) – coverage for historical contamination and ongoing site risk, including third-party bodily injury and property damage.

- Products Pollution Liability – protection for manufacturers and distributors whose products may contain or be linked to PFAS.

- Transportation Pollution Liability (TPL) – covers accidents and discharges during transit, which can be a major blind spot for clients moving goods or waste.

It’s not enough to offer “pollution coverage” in name. Agents need to understand what is actually included and what is silently excluded. At Jencap, we work closely with agents to review, interpret, and negotiate the policy language that matters, as a minor exclusion can mean the difference between full defense and total denial.

PFAS Litigation in the Real World

In the past 18 months, PFAS has gone from environmental acronym to headline-maker:

- Tyco Fire Products agreed to pay $750 million to settle claims tied to AFFF (aqueous film-forming foam), a primary PFAS source used at fire training sites, airports, and refineries.

- BASF Corp. is settling for $316 million over PFAS-contaminated water systems. The twist? The affected communities were often miles from the company’s operations, showing how far PFAS can travel.

- Carrier Global Corp. disclosed a massive $2.4 billion insurance tab tied to legacy liabilities, including PFAS. Yes, billion—with a “b.”

Insurers are paying attention, but clients? They’re often caught flat-footed, especially if they assumed PFAS wasn’t their problem. Many of these lawsuits name current property owners who had no involvement in the original contamination. Others hit manufacturers for trace elements in adhesives, coatings, or packaging. That’s the nature of PFAS liability. It’s retroactive. It’s mobile. And it’s indiscriminate.

Jencap’s Role: Translating Complexity into Coverage

It’d be much easier if PFAS insurance were conducive to boilerplate solutions, but it’s not that simple. It’s complex, jurisdiction-specific, and constantly evolving. That’s why Jencap approaches environmental insurance differently.

We act as your technical translator, strategic partner, and market matchmaker. We interpret ESAs and environmental data, helping you understand when PFAS findings are a minor concern versus a coverage-altering risk. We know where markets stand. Some carriers are backing away. Others are innovating coverage forms. We know who’s writing what, and under what terms. We craft bespoke programs that integrate pollution liability into broader commercial coverage. Because PFAS rarely operates in a silo, and your client’s coverage shouldn’t either.

In short: We structure protection that stands up when it counts. Contact Jencap today to learn more.