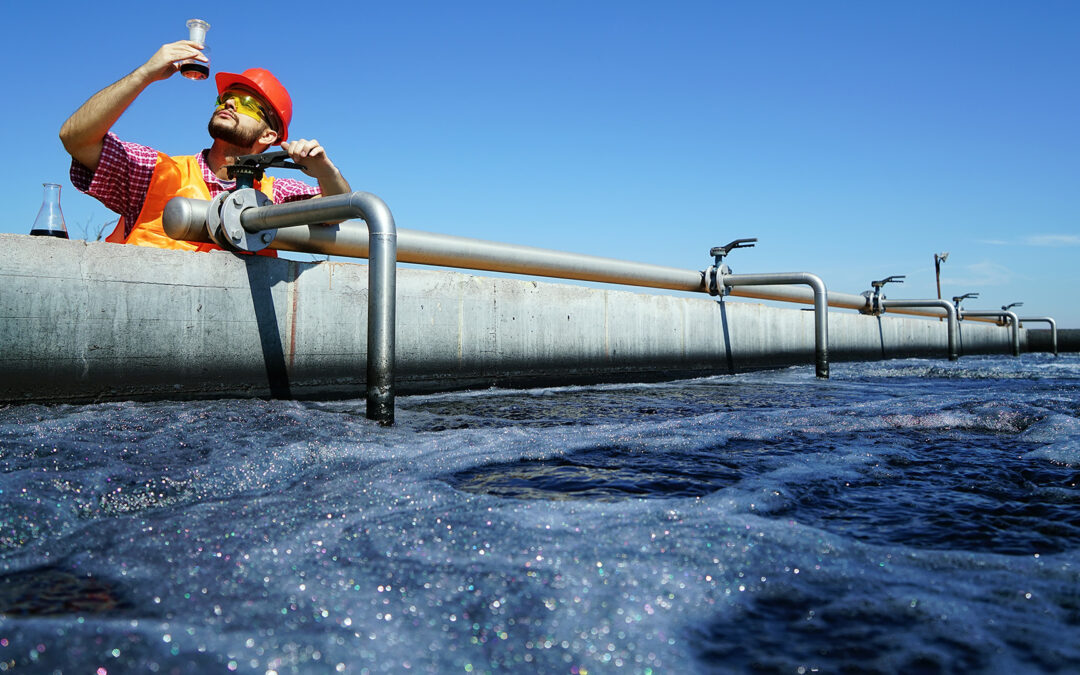

Environmental insurance (also known as Pollution insurance) provides coverage for loss or damages resulting from the unexpected release of pollutants, including claims for bodily injury, property damage, cleanup costs, and business interruption.

It’s important to know that standard General Liability and Property insurance policies exclude most losses connected to pollution. Unfortunately, many insureds mistakenly believe that their Liability and Property insurance policies cover pollution-related claims, losses, and damages, which leaves them exposed to potentially costly risks.

It’s also a mistake to only associate the need for Environmental insurance coverage with certain types of businesses, such as companies that produce hazardous materials. In fact, pollution comes from a variety of industries, businesses, and sources that you wouldn’t necessarily consider to be at risk. Pollutants are any irritant or contaminant; including smoke, vapor, soot, fumes, acids, alkalis, chemicals, and waste. Any material, substance, or product that is introduced into the environment for reasons other than its intended purpose can be considered pollution.

While many businesses would benefit from Environmental insurance coverage, the following industries have the biggest risk factors and need for specialized coverage:

- Industrial/manufacturing

- Energy

- Cannabis

- Real estate

- Agriculture

- Construction

- Transportation

- Hospitality

Environmental and pollution claims are rising year over year, and there are five main contributors to this trend:

Natural disasters. The rise in Environmental and Pollution insurance claims is partially driven by an increase in natural catastrophes, such as floods and earthquakes. Severe weather events can have major environmental repercussions; damaging buildings, construction sites, infrastructures, containment systems, etc. As a result, potential pollutants, including pesticides, fuel oil, animal waste, and more, can be released. For instance, after Hurricane Harvey hit the Houston area, there were damages to local petrochemical refineries and chemical plants, which released chemicals and petroleum into the environment. This resulted in significant cleanup costs and Environmental Liability exposures.

Aging infrastructure. Aging infrastructure is another driver of increased claims activity. In many industrial plants and other aging facilities, the machinery, equipment, drains, clarifiers, sumps, and below-grade structures don’t meet today’s environmental standards. If the building owners haven’t upgraded the infrastructure in decades, pollution has accumulated over the years. Now, instead of updating equipment to meet current environmental standards, many building and business owners are relying on their insurance policies to protect them from environmental losses. Businesses rationalize this practice by saying they can save money this way because their pollution protection policy rates, which may provide millions in limits, are lower than the cost to update their infrastructure.

Mold. We’ve seen an increase in mold and microbial claims recently, often due to contractors disturbing sewer lines and plumbing structures. Many property owners have discovered mold during renovation and construction projects, which are usually attributed to older buildings. Mold from water damage, condensation, and leaks is causing health illnesses in individuals exposed to it – such as asthma and other lung issues, sinusitis, bronchial issues, and skin rashes. Mold is an ongoing – and potentially costly – liability that can impact companies across all industries. Therefore, companies must develop a mold prevention plan to control moisture and prevent mold (and its related problems). This should include conducting regular site assessments to identify potential risk areas, inspecting roofs, HVAC systems, pipes, drainage, and airflow, and ventilating areas exposed to heavy moisture.

Evolving definitions of “pollution.” Pollution is not just caused by smoke and oil, as is the common perception. Consider this: several years ago, a food warehouse caught fire, causing the cheese and butter they produced to liquify and run into the sewer system. When these dairy products cooled and solidified, they clogged the sewer system, causing their neighbors to file business interruption claims. When the warehouse filed a claim on its General Liability insurance, it was denied, based on the policy’s pollution exclusion, resulting in an out-of-pocket expense of $550,000. In fact, a wide range of pollution and environmental claims are impacting all types of industries. In the hospitality industry, a woman died after contracting Legionnaires’ disease in a Las Vegas hotel’s Jacuzzi. Lawyers for the victim’s family proved that the hotel knew the bacteria was present in the building’s water system for months prior to the victim’s stay. This claim wasn’t covered under the hotel’s General Liability insurance, so the hotel had to pay millions of dollars to the victim’s family.

Chemical Contaminants. Glyphosate, a chemical in a popular weed killer sold globally, has been found to cause chronic health issues, including non-Hodgkin’s lymphoma. In addition to domestic chemicals, there’s been more recent scrutiny around PFAS chemicals, also referred to as “forever chemicals.” PFAS, which are used in numerous household items, cleaning products, fabrics, plastics, and more, don’t break down and can accumulate in the environment (and the human body) over time. Companies using, selling, or distributing glyphosates and PFAS have been found to be responsible for damages related to the use of the chemicals. In many states, claims are rising due to the presence of PFAS in groundwater. Exposure to the man-made chemical PFAS has been linked to adverse health effects, according to the Environmental Protection Agency. Some industry experts believe that PFAS exposure is a liability risk that could rival asbestos, and if that’s the case, the risk (and associated costs) could be huge.

Jencap specializes in Environmental and Pollution insurance for all industries and through our consultative approach, we position our agency partners for success by determining the necessary insurance coverages for their clients’ unique risks. Tap into the power of the Jencap platform.