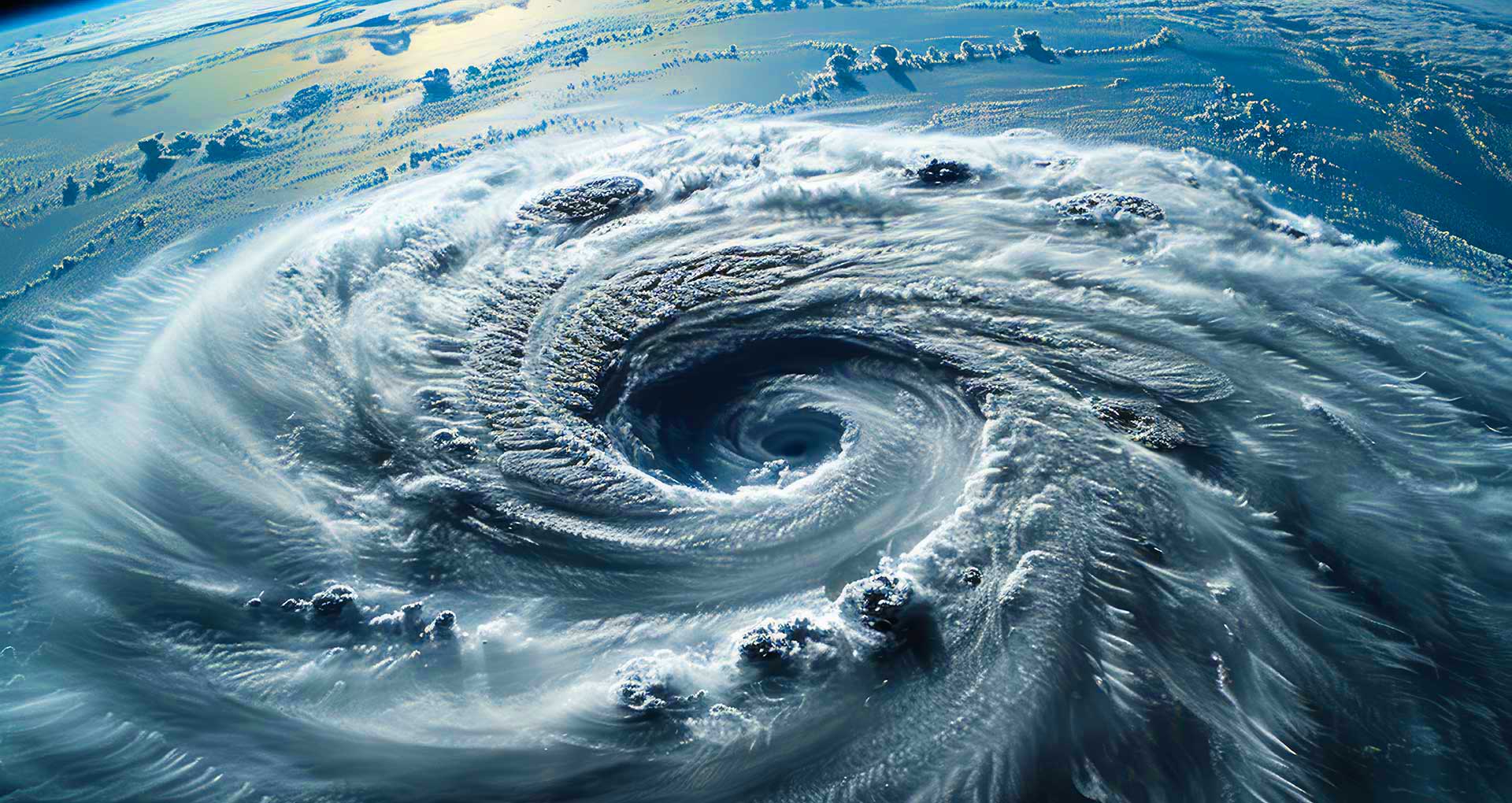

When it comes to cyber threats, insurance is designed to protect businesses and individuals from those risks. But what happens when the insurance industry is attacked? Recent headlines have insurance companies talking about vulnerability in a new way.

The Protector Becomes the Target

Large, cyber-savvy carriers are being forced offline. In the case of Philadelphia Insurance, a significant ransomware attack led to an ongoing service outage, raising questions about operational continuity and client confidence. Shortly after, Erie Indemnity reported what it called an “information security event.” While details remain limited, the network disruption lasted over a week, shaking trust and sparking speculation about breach severity.

Adding fuel to the fire, a warning from Google’s Threat Analysis Group and Mandiant revealed that Scattered Spider, a well-known cybercrime group, has now shifted its attention from retail giants to insurers. Their tactics? Impersonating employees, gaining access through clever social engineering, and deploying ransomware while negotiating extortion deals.

What This Means for Agents

When insurers are being breached, clients take notice. These stories are unsettling, yes, but they’re also powerful entry points for agents to lead the conversation around cyber insurance coverage. If the companies writing the policies aren’t immune, neither are your clients. That awareness and these headlines provide a natural way to start the conversation.

Cyber Liability Coverage: From Optional Add-On to Operational Necessity

Today’s cyberattacks make breaching data look like child’s play. Bad actors break through and shut down organizations, even those with robust security postures. And if that’s true for carriers, it’s even more so for clients with limited IT support, outdated systems, and low awareness of what their existing insurance coverage protects.

Many still assume general liability or property policies will cover cyber-related losses. In reality, they often don’t.

What This Means for Agents

Your clients may understand “business email compromise” or “social engineering fraud,” but they may not know whether their current insurance policy covers reputational recovery and data restoration. You can explain cyber liability coverage to them in the context of business continuity, revenue, and preventable legal challenges. Let these headlines frame your conversation, introducing cyber coverage as a core risk management tool often overlooked as luxury. Help your clients understand coverage gaps and how to fill them before they wake up to a breach.

Don’t Let Complexity Stop the Conversation. Let It Start One.

We get it. Cyber can feel intimidating. The technical terms, the evolving threats, and the inconsistent policy language. But here’s the good news: you don’t have to do it alone. At Jencap, we specialize in helping agents like you tackle cyber security. You bring the trusted relationship and client context. We provide the expertise, market access, and plain-language support that turns uncertainty into action.

Whether it’s explaining first-party vs. third-party coverage, debunking cyber insurance myths, or tailoring policies to specific industries, we’ve got your back. Be the first to bring up cyber with your clients. Show them you’re thinking ahead, watching the trends, and ready with a solution. With Jencap behind you, you’ll have access to:

- Leading cyber markets tailored to client risk profiles

- Myth-busting resources and client-ready talking points

- Support from real people who know how to make technical risks make sense

This is about protecting your client’s best interest and being prepared for tough conversations before clients raise fears triggered by these headlines. Don’t let them catch you off guard.