In the construction industry, staying ahead of emerging trends is crucial for builders and insurers alike. Not only can advances in construction technology reshape the way we build, they can also influence builders’ risk insurance exposures.

According to a recent article in Insurance Journal, there are three building innovations that agents with construction clients need to watch closely: 3D construction, solar panels, and mass timber construction. Each of these has clear benefits in terms of cost, sustainability, and safety, but they also introduce new risk exposures that can impact builders’ risk policies.

- 3D Construction: The 3D printing construction market is growing at an astounding rate. Two years ago, the market size hit $1.4 billion worldwide, but it’s estimated to reach an astounding $751 billion by 2031. By printing scale prototypes, construction components, and even entire structures, builders can use fewer materials to complete projects in less time and with lower labor costs.

While this has clear benefits, agents and their clients need to be aware that there is no government regulation or industry standard for 3D construction — something other construction methods already have. This means risks can vary from project to project, which can make underwriting tricky. In addition, builders need to be aware that although carriers may cover the collapse of a building under a builders’ risk policy, they may be reluctant to cover the 3D component that caused the collapse. - Solar Panels: Solar panels have continued to grow in popularity as a way to use greener energy and cut down on electricity costs for consumers. According to the Solar Energy Industries Association, solar installations in the U.S. are expected to triple over the next five years.

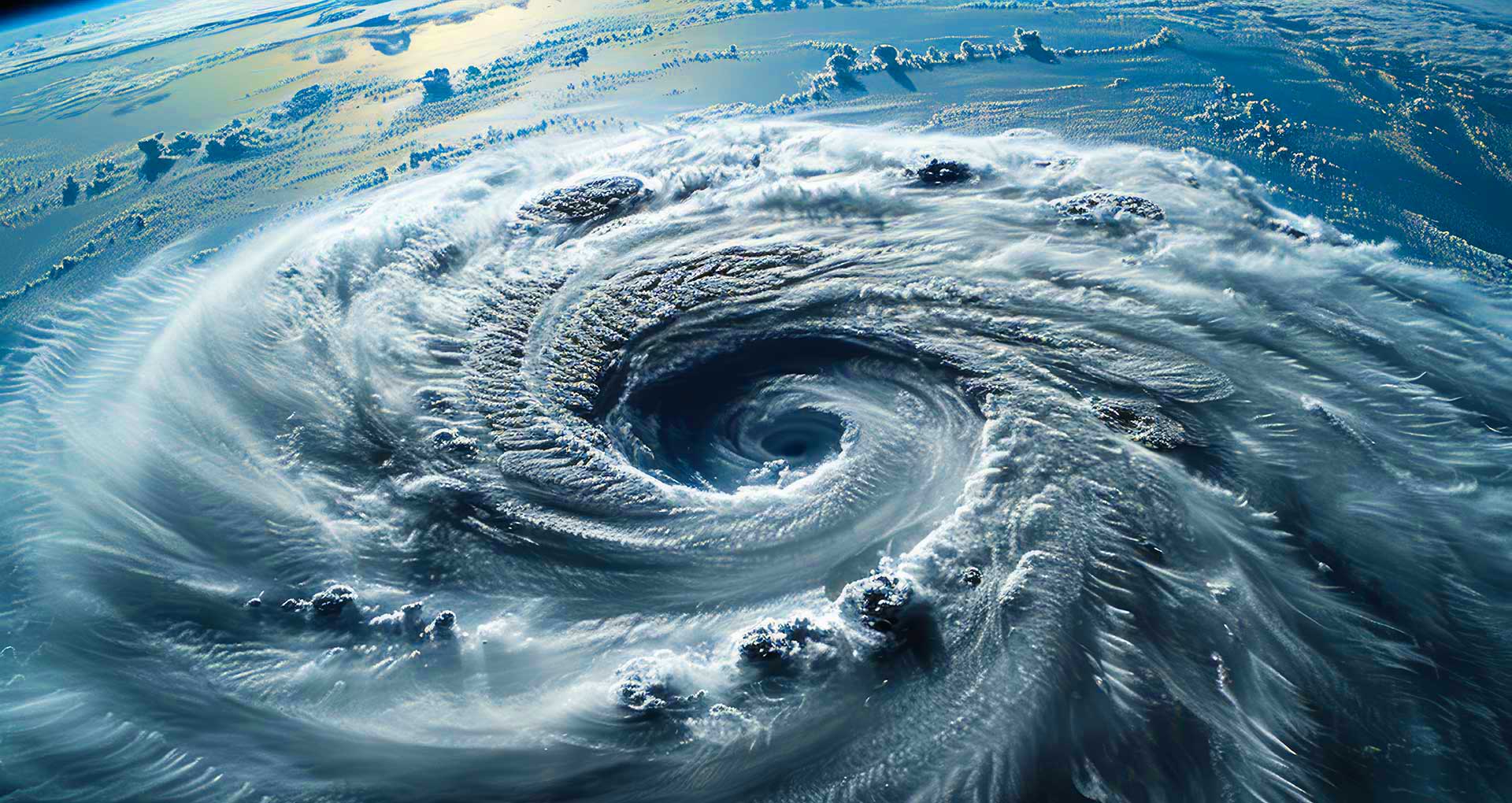

Agents need to remain vigilant when reviewing policy conditions for their clients. Despite their clear potential, solar panels do have inherent risks that underwriters can’t ignore, namely damage from natural catastrophes like hurricanes, tornados, floods, and hail. Underwriters may also consider things like the qualifications of the electricians and contractors responsible for installation, whether panels are installed on the roof or ground, and other panel features.

It’s important to keep in mind that terms can vary between carriers when it comes to common solar panel risks like “micro-cracking,” for example — some carriers offer coverage, others limit coverage, and others exclude coverage entirely. - Mass Timber Construction: Mass timber is a category of engineered wood products, manufactured by bonding together large wood panels or beams to create larger and more robust structural elements. Not only is it a sturdy, safe, and low-carbon substitute for concrete or steel, it is less prone to fires than conventional lumber — which can be attractive from an insurance underwriting standpoint.

However, mass timber can be more sensitive to weather and moisture, which could impact a builder’s water deductibles because carriers can anticipate risks for warping. In addition, builders need to keep in mind that although mass timber components may be expensive, they still may not see a decrease in their builders’ risk insurance rates. Their policy premium will still be calculated based on the value of the total completed project.

Read the full Insurance Journal article for more details and insights into what agents should consider when working with clients who use these construction innovations.

Specialized Technology Requires Specialized Insurance Knowledge

Even though construction is an industry that’s been around for a long time, advances in construction technology are dramatically changing its landscape. When working with clients who use innovative methods and materials — like 3D construction, solar panels, mass timber, and others — it’s critical that agents understand the nuances of the space in order to properly protect their clients.

According to Joseph Leston, Senior Vice President of Jencap Specialty Insurance Services, “It can be tough to stay current and sufficiently informed on emerging innovations and how they can impact — positively or negatively — a builders’ risk policy. Brokers who specialize in construction work with these kinds of policies all day, every day. They know how to present the risks — what information underwriters want and need to see to clearly assess the risks. They also know what details often get overlooked during a policy review and can lead to problematic gaps in coverage.”

Jencap’s construction expertise is well-established and ever-growing. Our specialty brokers will work with you to build a program that fits your clients’ unique needs and situations. We can handle any range of risks for any type of construction business — from artisan contractors and carpenters to commercial contractors and luxury home builders. Contact Jencap today for a quote.