| WHITE PAPER |

The Jencap Weather Report:

HOW CLIMATE CHANGE IS

SHIFTING THE INSURANCE INDUSTRY

From wildfires in the West to hurricanes in the East, weather-related disasters continue to impact communities nationwide and tally up unprecedented losses. Read on to learn why insurance professionals and insureds alike are feeling the heat—and how it’s impacting coverage.

SECTIONS

01. Introduction

The data is clear—climate is changing world-wide. Global temperatures keep climbing, causing shifts in weather patterns and an uptick in natural disasters.

02. The Rise of Natural Disasters

In the United States, we are experiencing a rise in the most costly natural disasters. Devastating wildfires, hurricanes, floods, and temperature extremes are driving unprecedented losses from coast-to-coast.

03. The Catastrophe Cascade

When it comes to climate-driven disasters, one severe weather event can prompt a cascade of others. The result? An increasing number of costly insurance claims forcing higher premiums, reduced capacity, and less insurance protection.

04. CAT Modeling

Though no one can predict with absolute certainty when or where the next disaster will hit or how severe it will be, Catastrophe (CAT) Modeling is an indispensable tool for managing risk and proactively protecting against loss.

05. Conclusion

Now, more than ever before, our communities need the security and protection the insurance industry provides. In the face of global climate change, we have new opportunities to reimagine how we protect against weather-related risks.

01. Introduction

Weather used to be the mundane, agreeable topic you discussed at dinner parties and family holidays when trying to avoid politics and religion. The weather, however, is now far from boring—many would argue it’s even a bit controversial. …Enter climate change.

Climate change is a “hot” topic in the U.S. today. The vast majority of Americans (72%) believe that climate change is real, but they Source: NASA are less certain that it directly affects weather (64% think it does, while 7% don’t, and another 29% remain unsure). Regardless of public opinion, it’s difficult to dispute the facts: our global climate is changing, weather patterns are shifting, and the frequency of natural disasters is rising—all of which are significantly impacting the insurance industry.

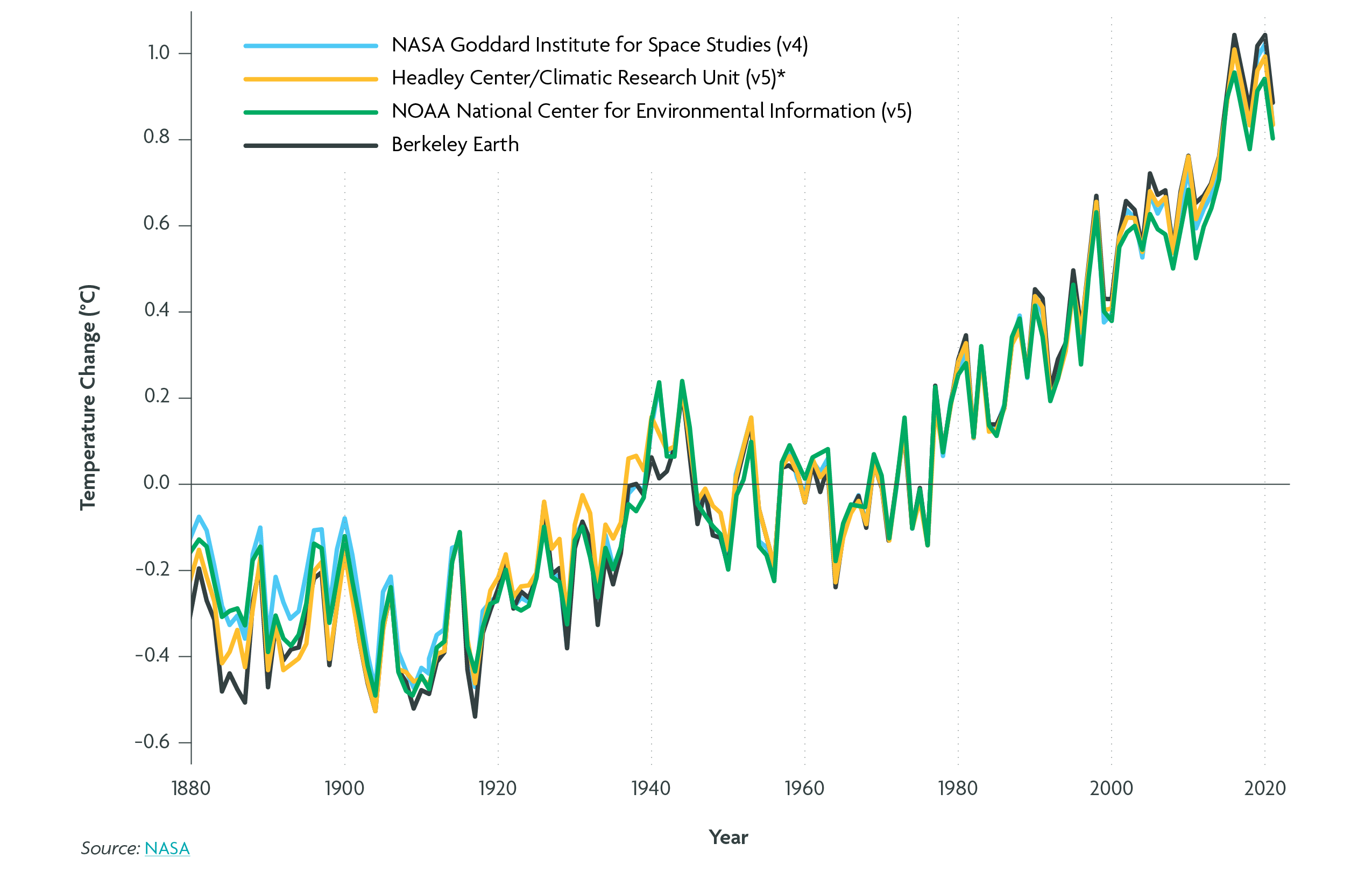

Average Global Temperature Change Over Time

The data speaks for itself: global temperatures are warming and multiple studies from independent sources confirm this trend.

02. The Rise of Natural Disasters

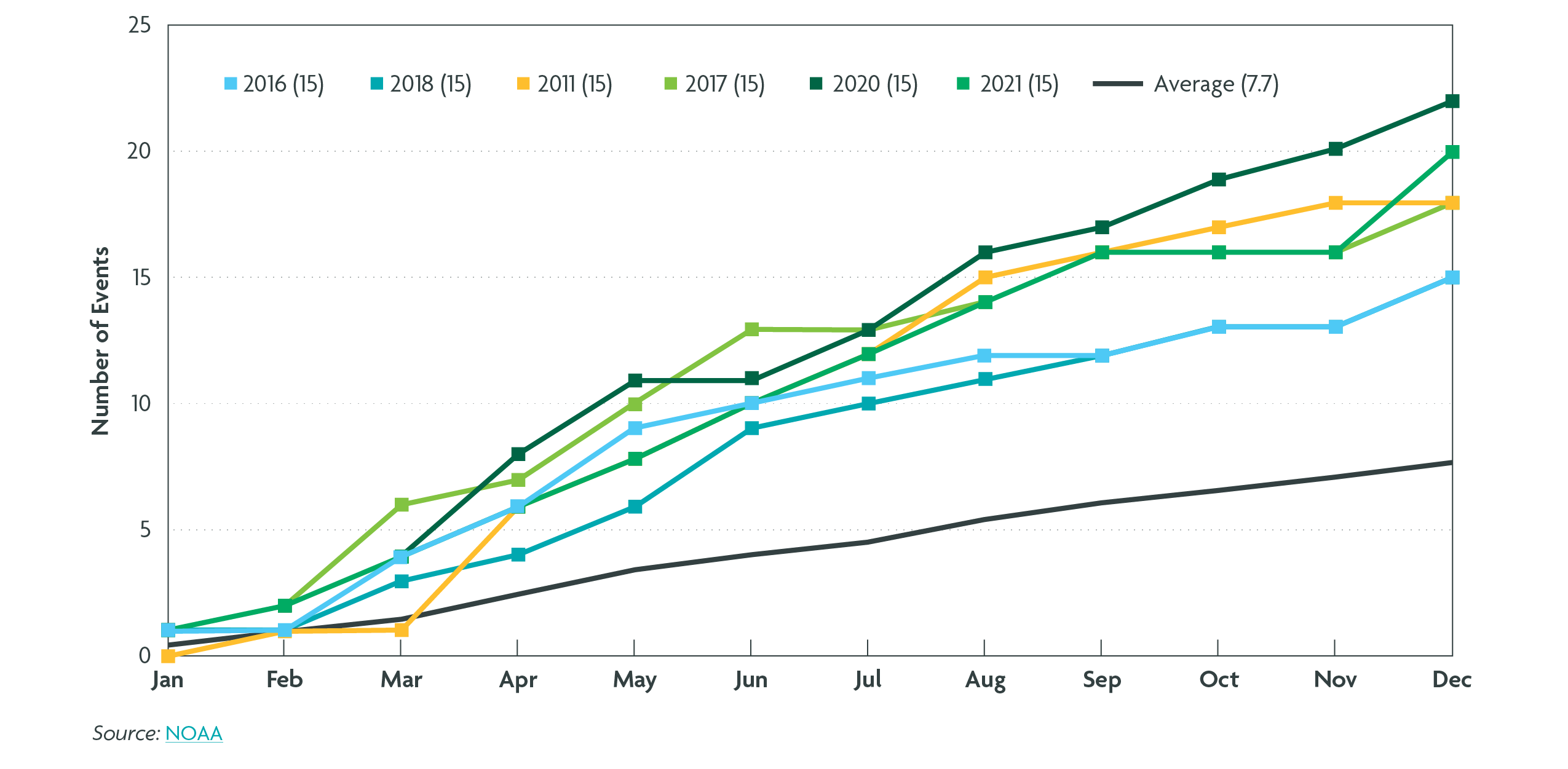

There’s a global uptick in the number of weather-related disasters, and the United States is seeing a steep rise in the frequency of the most costly disasters. The National Oceanic and Atmospheric Administration (NOAA) releases an annual report tallying disaster events totaling over one billion in damages. Last year alone, the U.S. experienced over 20 individual billion-dollar weather and climate-related disasters—a combined estimated cost of $145 billion. Those numbers don’t include disasters with price tags less than one billion, so the total losses for 2021 are actually much higher.

Among the most notable weather-related disasters are wildfire, hurricanes, flooding, and extreme temperatures. Let’s break each of these down to better understand the trends and their impact on our nation’s losses—and ultimately, the insurance industry.

Hurricanes

Each year, businesses and residents across the Atlantic and Gulf coasts prepare for the winds, rains, and flooding from hurricanes and tropical cyclones. On average, the United States is hit with five hurricanes every three years. Of those five, roughly two reach the status of major hurricane (category 3 or higher), the storms causing the most damage.

Greater Reach

Hurricanes can be particularly devastating due to their breadth of reach. The effects of Hurricane Ida, for example, extended to nine different states, contributing to $70 billion in damage for the 2021 Atlantic hurricane season. Real estate analytics firm CoreLogic estimate that more than 31 million homes are at risk for hurricane wind damage across the Atlantic and Gulf coasts. Of those homes, roughly eight million are also at risk for coastal storm surge damage.

1980–2021 United States Billion-Dollar Disaster Event Count (CPI-Adjusted)

The total volume of billion-dollar extreme weather events in the United States has continued to climb over the past 30 years.

Greater Destruction

Global climate change is fueling annual hurricane activity, particularly in regards to rainfall volume and cyclone intensity. Although the overall frequency of hurricanes isn’t expected to increase, NOAA scientists anticipate the ones that do occur will be more destructive. One reason is because as the global temperature rises, the earth’s air is capable of holding more water—the warmer the air, the more water it can absorb. Hurricane winds pull the surrounding moist air along with it, dumping it out as intense rain.

As a result, we can expect to see more Category 4 and 5 hurricanes, increased coastal flooding, and likely heightened risks for property damage and losses across hurricane-prone areas of the country.

FLOODING

Flooding is the accompanying “wingman” for other extreme weather events. According to FEMA, flooding occurs in 90% of all natural disasters in the United States—coastal flooding from rising sea levels, flash floods from major storms and torrential rains, or inland flooding from moderate rain accumulation. And although flooding can happen almost anywhere, it disproportionately affects areas in the Gulf, Appalachia, and the Northwest.

Flooding Is Costly

Any flooding can be devastating as water damage is in fact far more severe and costly than fire damage. Even with a single inch of flooding in a home, property losses can total upwards of $25,000. It’s difficult, however, to place an accurate number on the total cost of flood damage sustained nationwide each year.

NOAA calculates the costs for all floods that total over one billion dollars in damage each year. Last year, for instance, there were two catastrophic floods that each caused over one billion dollars in damage (for a combined total of $2.7 billion). But as Oceanographer and NOAA Sea Level Expert Dr. William Sweet points out, “There has been a real challenge to put a cost on the lesser extremes.” NOAA’s annual numbers don’t include all the smaller floods that take place each year—meaning that the total cost of flood damage across the United States is actually much, much higher.

Sea Level Rise—Yes, It’s Happening

New flood risk maps published by researchers in Nature Climate Change Journal predict that over the next 30 years, flood damage costs will increase 26% due to climate change alone. One clear reason for this is rising sea levels, which Peter Sousounis, Verisk vice president and director of climate change research, notes is tied to warming temperatures.

“As the oceans warm, they expand volumetrically. As the climate warms, more ice melts and that’s contributing to rising sea levels, as well. By 2050, most of the major coastal cities are preparing for an additional foot of sea level rise. We have only had about eight inches of sea level rise in the last 50 years. And we’re looking at another foot in 30 years. That’s very sobering.”

—Peter Sousounis, vice president and director of climate change research at Verisk

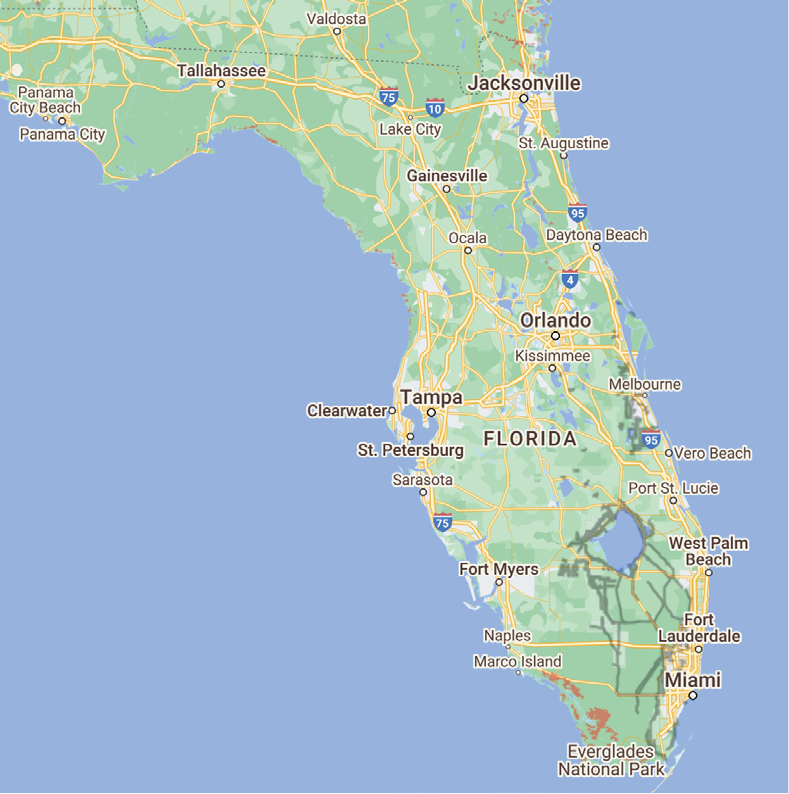

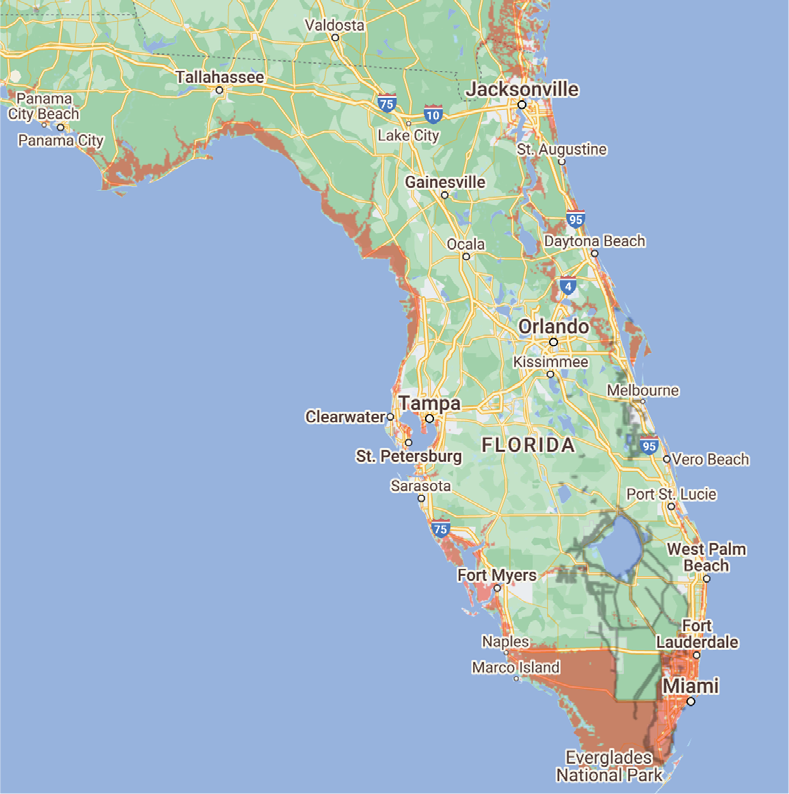

Climate Central produces an interactive sea-level rise map that creates a simulated view of water level risk based on projected year, water level, temperature and more. The image on the left is Florida today. The image on the right is what Florida would look like with 12 feet of sea level rise, orange indicating what parts would be under water.

Source: Climate Central

Heavier Rains

Another reason for the rising risk of flooding, Sousounis explains, has to do with the amount of moisture the air can hold as it gets warmer. “As temperatures increase, the atmosphere holds more water vapor, which can be released in the form of heavy downpours.” This can lead to flooding, especially if heavy rains fall in areas where the ground can’t absorb water fast enough, or in urban areas where the water doesn’t have anywhere to go.

Opportunities for Insurance to Lead

When it comes to flood risk, Kathleen Schaefer, UC Davis Ph.D. candidate and certified floodplain manager, sees a real opportunity for insurance professionals to take part in earlier conversations, before disaster strikes. Schaefer’s research reimagines the role of insurance in working within their local communities. “Insurance could be more proactive partners and help identify and address risks, rather than coming in on the back end to help pick up the pieces of flood disasters that might have been avoided or mitigated.”

Schaefer envisions, for instance, possibilities for entirely new programming that builds community resiliency, mitigates risk and insures whole communities; including municipal structures, like city halls, public parks, water treatment plants, and more.

WILDFIRES

Year after year, states in the Southwest brace themselves for wildfires. On average, the United States experiences roughly 70,000 wildfires per year, putting an estimated four and a half million homes at risk.

Although the overall number of wildfires we experience annually isn’t trending upward, the total areas affected and acres burned are. Fire “season” is also growing longer, with parts of the Western U.S. experiencing a month longer fire season than what was typical just three decades ago. Even states not typically known for wildfire activity, like Tennessee, are feeling the heat. These trends translate to substantial damages—losses for wildfires across the United States last year are estimated somewhere between $70 and $90 billion.

Wildfires are different from other natural disasters, due to the direct role humans play in their likelihood. Ninety percent of fires are caused by people—poorly extinguished campfires, vehicle backfires, carelessly discarded cigarettes, equipment malfunctions, for example—as opposed to “natural” events, like lightning. This can make wildfires incredibly difficult to anticipate. “It can happen like an earthquake, without warning,” explains Jencap Western Region President Kris Bauer. “We’re starting to expect them every year, but can’t predict when or where.”

While humans may strike the proverbial match, climate-driven weather conditions make wildfires more likely and much more devastating. According to Jencap Vice President and Climate Change Strategist Louis Reynaud, “Extreme heat, wind pattern changes, and drought caused by climate change lead to the perfect conditions for significant wildfire events.” Heat and drought dry out the landscape, and the parched vegetation encourages ignition and fuels the spreading flames.

Wildfires play a particularly vicious role in global climate change—not only is their intensity and destruction heightened by a warming climate, but they actually worsen climate change. Reynaud explains, “They exacerbate the release of carbon-dioxide into the atmosphere, while also burning the natural vegetation needed to sequester carbon-dioxide or convert it to oxygen. The excess carbon-dioxide exacerbates heat, drought, and wind patterns further, leading to more frequent and significant wildfires.”

Total Number of Wildfires Reported Yearly,

1983–2020

TEMPERATURE EXTREMES

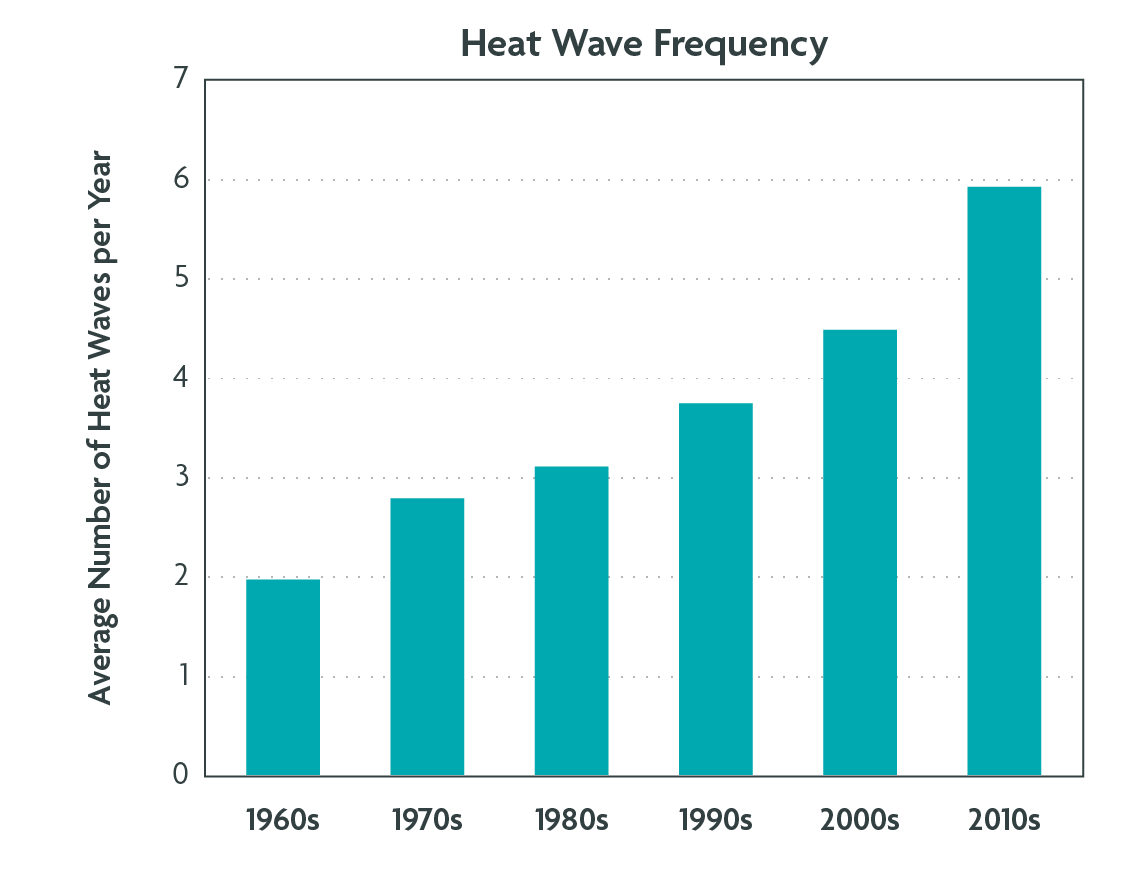

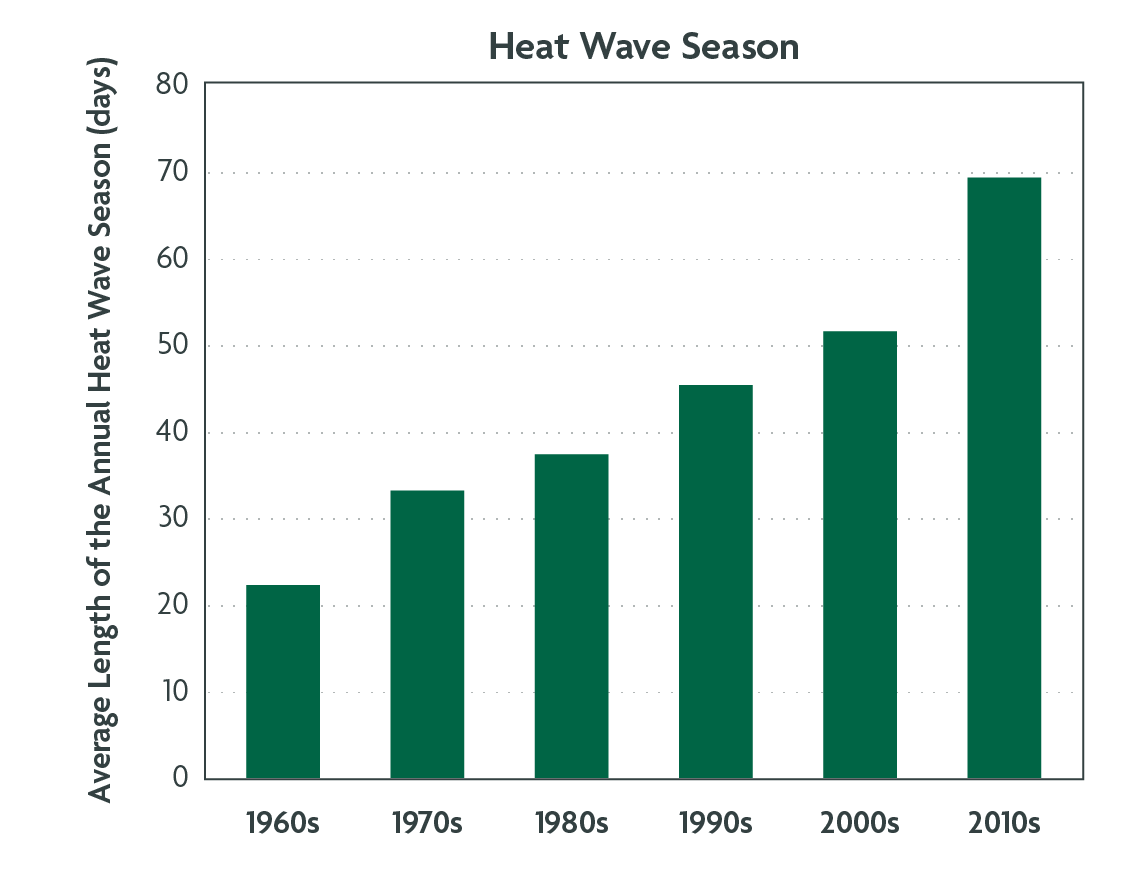

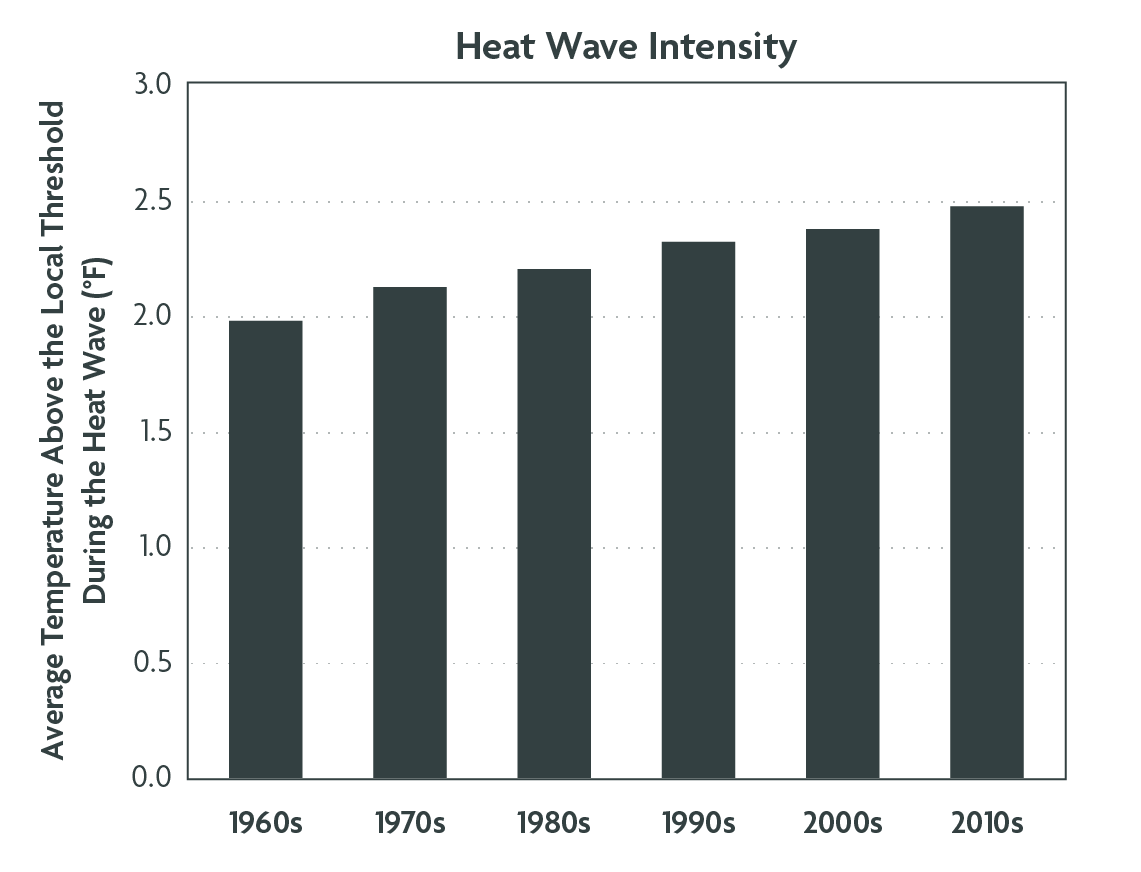

As the average global temperature slowly creeps up, annual heat waves in the United States have steadily grown in frequency, intensity, and duration. According to the Environmental Protection Agency, over the past 60 years, the average number of heat waves in the U.S. has climbed from two to six per year and the average heatwave duration is 47 days longer.

Prolonged warmer temperatures translate to more than just general discomfort. Heat waves can cause a litany of insurance losses and damages, including things like heat-related illness or death, business disruptions due to power loss, transportation interruptions, and crop failure—just to name a few.

It’s Not Just High Heat

Although the world as a whole is getting warmer, it’s important to remember that different regions of the world are experiencing extremes on the high and low ends of the spectrum. Canaan Crouch, managing director at Jencap Specialty Insurance Services and environmental expert, points out, “On average, there’s a warming trend around the globe, but there are other areas getting wetter and colder. There is indisputable climate change occurring, but the specific effects are regional.”

The winter storms of 2021 that spread across the central U.S. are one example of the global warming-cooling disparity. Last winter was, on average, one of the warmest winters experienced across the U.S., yet February 2021 saw the coldest temperatures since 1989. The accompanying winter storms took down the Texas power grid, left millions without power for days, and racked up an estimated $24.5 billion in damages. Climate researchers link this freak winter extreme to the warming arctic and a weaker polar vortex that drives cooler temperatures southward.

Heat Wave Characteristics in the United States by Decade (1961–2019)

03. The Catastrophe Cascade

As if the damage from one severe weather event isn’t bad enough, one disaster can lead to a cascade of others. Extreme heat and drought create conditions where a single spark can set acres of land ablaze. And in a cruel twist, flooding can follow droughts and fire if the parched and scorched earth is too dry to soak up a sudden deluge of rain. In turn, heavy rains and flooding can trigger landslides, as rushing water sweeps up dirt, rocks, and debris and carries it down to lower elevations.

The cascade of effects from extreme weather does not stop there. Catastrophic events within a single community or region—a wildfire in California, mudslides in Oregon, a heatwave in Arizona, a hurricane in the Gulf—add up, and the compounding effects of these losses are felt across the insurance industry. Estimated insured property losses last year rose to $92 billion, putting 2021 in second place for the most costly loss year in the past decade. The title for first is held by 2017, which—thanks to disasters like Hurricanes Harvey and Irma and the Tubbs and Atlas Wildfires—racked up $144.2 billion in insured losses.

The Main Concern for Insurers

Scientists warn that if climate change and rising global temperatures aren’t addressed now, the prevalence and severity of natural disasters will only get worse. No surprise, this is top of mind for many insurers.

According to research released by Capgemini, 44% of insurance executives cite climate change as a leading concern, alongside cyber security and tech threats. An overwhelming majority (74%) worry about climate change’s effect on the ability to provide coverage as risks in certain markets magnify. Profitability is also a concern, as rising climate-related claims and total losses negatively impact loss ratios and drain capital.

High Premiums and Disappearing Capacity

How do coverage and profitability concerns play out in the insurance marketplace? California and its wildfire activity provide one clear example. Over the past 60 years, the average estimated annual wildfire payout in California has risen from less than $100 million to $4 billion. As wildfire damage worsens, the capacity for coverage shrinks in response to the rising associated risk.

According to Bauer, “Insurance has become really crunched in capacity. There’s still capacity available, but the amount of insurance one company is willing to put up on wildfire- and weather-driven risks is small.” Logically, premiums are increasing faster in areas that are at a higher risk for wildfires, but these rate hikes may not be high enough to fully reflect the overall risk, forcing some carriers to opt out of the wildfire market entirely.

“Insurance has become really crunched in capacity. There’s still capacity available, but the amount of insurance one company is willing to put up on wildfire- and weather-driven risks is small.”

—Kris Bauer, Jencap western region president

04. CAT Modeling: More Than Just a Tool for Assigning Risk

While no one can predict the future with absolute certainty, Catastrophe (CAT) modeling is providing a way for the insurance industry to manage—and prepare—for these extreme weather events. CAT models simulate the likelihood of possible catastrophic events and estimate potential losses.

These models are incredibly complex, based on a multitude of rigorously collected data points. Put very simply, they take into account the historical record of different types of disasters, where they’re prone to occur, and the kind of damage they cause to different types of properties. Using those robust data sets, the models provide a computer-generated simulation of damages a property might sustain from a particular disaster, along with associated costs.

CAT models are constantly evolving, factoring in everything from building code changes and shifts in urban development to economic inflation—as well as climate change. According to Sousounis, models need to be able to appropriately balance current risk, as well as future projected risk. He explains, “When Verisk releases a CAT model, it’s supposed to reflect the current risk, which includes the current climate. But we’re not going to update that model every year. It’s prohibitively expensive and resource intensive. So we want that model to have a useful lifetime of, conservatively, five-to-ten years. We want that model to continue to reflect the current climate over the next 10 years.”

Getting the Most out of Models

Insurance carriers rely on CAT modeling to inform their decisions about a risk’s underwriting eligibility and set pricing and terms that appropriately reflect the risk exposure. The strength and accuracy of the model relies on the quality of information it uses to assess risk—which is why underwriting is so important. Director of Jencap Specialty Insurance Services and Risk Modeling Expert Bruce Norris notes that strong underwriters are not only very thorough and thoughtful about how they describe the risk they put into the model, they are also able to leverage their experience to identify “good risk.”

Models also provide valuable insights that agents and brokers can—and should—use to partner alongside their clients to mitigate risks. According to Norris, “If they just ‘push the button’ and walk away with whatever number the model generates, that doesn’t provide much value. But if they take that number, think about it, reassess it, and run through different ‘what if’ scenarios, then they can work with the client to create a (mitigation) strategy. The model allows us to explore different options and design a better outcome.”

“When Verisk releases a CAT model, it’s supposed to reflect the current risk, which includes the current climate. But we’re not going to update that model every year. It’s prohibitively expensive and resource intensive. So we want that model to have a useful lifetime of, conservatively, five-to-ten years. We want that model to continue to reflect the current climate over the next 10 years.”

—Peter Sousounis, vice president and director of climate change research at Verisk

05. Conclusion

There’s no denying that the impacts of global climate change are rippling across the entire insurance industry, affecting policyholders and insurers alike. Insurance has historically been a constant source of security and protection, helping individuals, businesses and communities pick up the pieces after disaster strikes. That security is needed now, more than ever. And as we move forward into a future filled with climate-driven uncertainty, the industry has an opportunity to question and reimagine how we can change, evolve, and work within our communities nationwide to navigate the future’s weather-related risks.

You can trust that Jencap will remain at the forefront of the climate and extreme weather trends affecting you and your clients. Jencap is your reliable source for expertise and market access, and we’re ready to guide you through the uncertainty and complexities that lie ahead. Our talented team of specialists will work alongside you to source the peace of mind your clients need.

Stay Informed

Want to receive information from Jencap on timely marketplace trends, hot new product and program launches, and valuable product expertise that will set you up to win? Sign up to receive email communications from Jencap.

Industry Insights

Get the White Paper: Download The Jencap Weather Report: How Climate Change is Shifting the Insurance Industry today.

© Jencap Group LLC. All rights reserved.