For businesses that manufacture and sell their own products, there’s always a nagging worry that something could go wrong with a product. No matter how carefully a company manages their supply chain or how rigorous they are with product testing, there’s a chance a product could fail, malfunction, or not perform as expected.

Often the consequences of a product failure are trivial and barely noticed. In other situations, however, it can result in someone being injured or property getting damaged. If this happens, businesses can get stuck with hefty costs as they work to make things right. Attorney fees, legal expenses, settlement costs, and medical payments can pile up quickly, potentially decimating a company beyond recovery.

Having the proper business insurance in place protects companies from these kinds of risks and ensures they’re also able to do right by their customers if the unexpected happens. For businesses that make or sell products, this means having both general liability and product liability coverage.

Let’s talk through some of the key differences between the two coverage types and why you need to secure both.

First, a General Liability Primer

As a business owner, it’s likely that one of the first coverages you took out was general liability. Also known as business liability insurance or commercial liability, general liability insurance offers companies baseline protection from claims involving bodily injury and/or property damage. It covers a wide range of risks that can pop up with everyday business operations. For instance:

- Injuries to customers or bystanders (excluding employee injuries, which are covered by workers’ compensation)

- Damage to someone’s property, caused by your business or employees

- Libel or slander accusations

- Harmful advertising

Let’s say a customer slips on water from a spill in your place of business, breaks their arm, and decides to sue. Perhaps one of your employees knocks over a can of paint while they’re working in a client’s home, ruining the client’s Persian rug. Or maybe one of your recent advertising campaigns unintentionally makes claims that are false or misleading. General liability would cover any resulting costs from these mishaps — from legal fees and medical expenses to replacement or repair costs.

General liability coverage is a necessity for any type of business, and in some cases, you won’t be able to conduct business without it. Landlords, clients, or contractors may refuse to do business with you unless you’re able to show proof of general liability coverage. And some types of professionals, like construction contractors or personal trainers, need proof of general liability coverage to obtain professional licenses.

General Liability Doesn’t Cover Everything

Despite its broad nature, general liability doesn’t necessarily protect your business from damages or injuries caused by the products you make or sell.

Let’s say you manufacture kids’ bikes and a defect in the product causes a small part to come loose. The wheel falls off while a child is riding the bike, resulting in a crash and trip to the emergency room for a broken wrist and stitches. If the child’s parents choose to sue, your business could be responsible for the child’s medical expenses and settlement costs. You’d also be responsible for the costs of hiring an attorney to represent you in court.

This is where product liability comes into play.

What is Product Liability Coverage?

Product liability is specifically designed to protect businesses from situations where their product hurt someone or caused damage to property. It covers claims related to:

- Flaws in a product’s design

- Defects that occur during the manufacturing process

- Improper or inadequate product instructions or warnings

Can You Do Without Product Liability Coverage?

You may think you can do without product liability coverage because the chance of a severe product malfunction or defect is so unlikely. And you may be right, but don’t be too quick to make that decision. Getting hit with a single product liability lawsuit is something that can financially cripple a company.

Let’s look at some numbers.

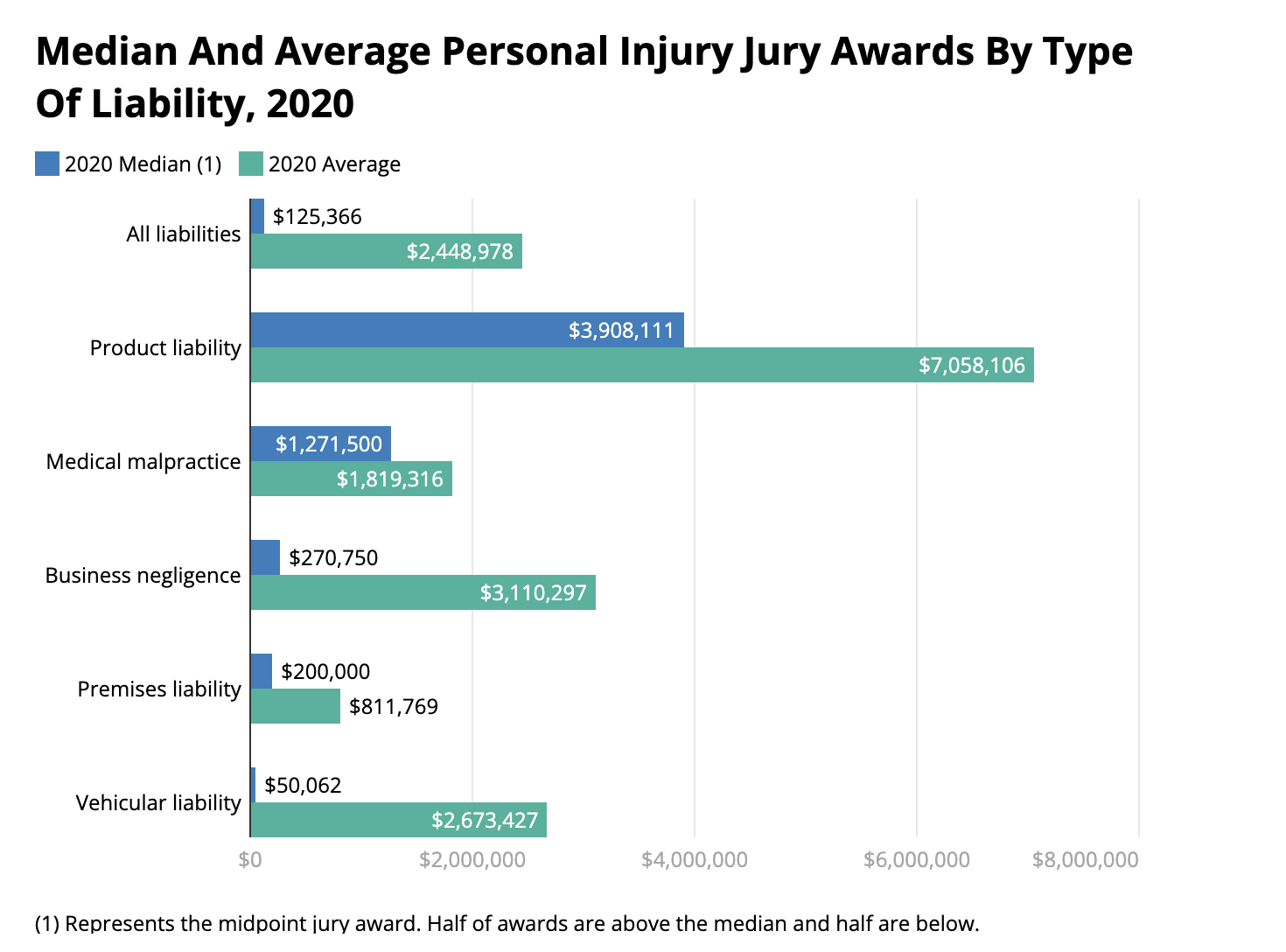

Only 3-5% of personal injury cases ever make it to trial; the vast majority are settled out of court. 3-5% sounds like a very small number. But consider this: Of the cases that do go to trial, about half rule in favor of the plaintiff and result in a jury award. In these cases, the reward amounts can be staggering. According to the Insurance Information Institute, product liability cases garner the highest jury award payouts, with a median amount of $3.9 million.

Source: Insurance Information Institute

In other words, as a business, if you wind up going to trial over a product defect that caused some sort of personal injury or property damage, you have a 50-50 chance of getting hit with a payout that could be impossible to recover from.

Product liability insurance is a safety net that protects you and your business from this risk. You hope you never need it — but if you do, you’re glad it’s there.

What Businesses Need Product Liability?

If you make or sell products — food, toys, devices, clothing, etc. — you should consider product liability a necessity. This extends to any business involved in:

- Manufacturing

- Selling wholesale or retail

- Product importing

- Product installation

Jencap has industry-leading casualty brokers with specialized teams for every line of coverage, including general and product liability. Whether your clients need packaged insurance solutions or standalone coverage, we have you covered. Contact us today to learn more.