| WORKERS’ COMPENSATION INSURANCE INDUSTRY TRENDS |

The New Era of

Workers’ Compensation:

Powered by Data,

Driven by Outcomes

Contributors:

Jeff Sandy, EVP National Workers’ Compensation, Jencap

Ariel Gorelick, Global COO, AmTrust

AI isn’t new to Workers’ Compensation,

but its influence is expanding.

From improving account selection to accelerating claims, flagging fraud, and streamlining return-to-work planning, technology is changing how the industry evaluates risk and delivers outcomes. Let’s explore where those shifts are happening, how you can take advantage, and why Jencap is the partner to put it all into action.

The Numbers Don’t Lie

AI is Already Making an Insurance Impact

Speed, Accuracy, and Efficiency: AI in Workers’ Comp

Artificial intelligence is reshaping how brokers and retailers handle workers’ compensation quotes. In this conversation, Jeff Sandy, EVP of National Workers’ Compensation at Jencap, and Ariel Gorelick, EVP and Global COO at AmTrust, share how AI-driven tools are accelerating turnaround times, reducing errors, and streamlining small commercial quotes. With real-world examples—including award-winning solutions—they show how something as simple as snapping a photo or dictating a request can generate fast, accurate quotes, giving brokers a powerful competitive edge.

The Flip Side of AI

The policy may look the same on paper, but agents feel the difference long before it’s bound. Today’s tech-forward carriers are streamlining the quoting process, delivering faster turnaround and smarter account selection. Once in place, real-time data and automation continue to drive down claim costs and reduce friction, giving agents a measurable edge in a competitive, margin-thin market.

Claims Processing Lag

Paper forms, phone tag, and slow first reports drive up costs.

Instant Digital Intake & Triage

- NLP reads the injury report in seconds

- Low-severity claims auto-routed for same-day payment

- Agents show “speed to service” credibility & shave claim expenses

Guesswork on Claim Severity

Reserves set too high or too low hurt the bottom line.

Predictive Analytics

- Risk scores blend job class, age, and prior loss data

- Flag claims are likely to escalate, so adjusters intervene early

- More accurate reserves = fewer surprises at audit time

Fraud Sneaks Through

Anomalous patterns hide inside thousands of data points.

Real-Time Fraud Detection

- Machine learning surfaces suspicious billing codes or provider patterns

- Immediate alerts curb leakage before dollars leave the door

- Agents deliver cleaner loss runs and stronger renewal positioning

Lengthy Return-to-Work Timelines

Each extra day off work snowballs into higher indemnity.

AI-Guided RTW Planning

- Models compare treatment paths against millions of historical cases

- Suggests best-fit medical providers and RTW timelines

- Faster recovery keeps premium mod in line and clients happy

Manual Application Completion

Rekeyed data and inconsistent workflows slow down quoting.

Automated, Instant Quotes

- AI pre-fills and validates application data in real time

- Routes submissions to matching markets for faster decisions

- Agents get accurate quotes faster—no paperwork pile-up

AI + Expertise: Finding the Right Balance

AI is bringing powerful new capabilities to Workers’ Compensation, but it’s not a replacement for human expertise. The best outcomes happen when carriers, claims professionals, and agents blend machine-learning insights with experienced judgment and personal connection.

Where Machine Learning Helps

Where Human Expertise Is Essential

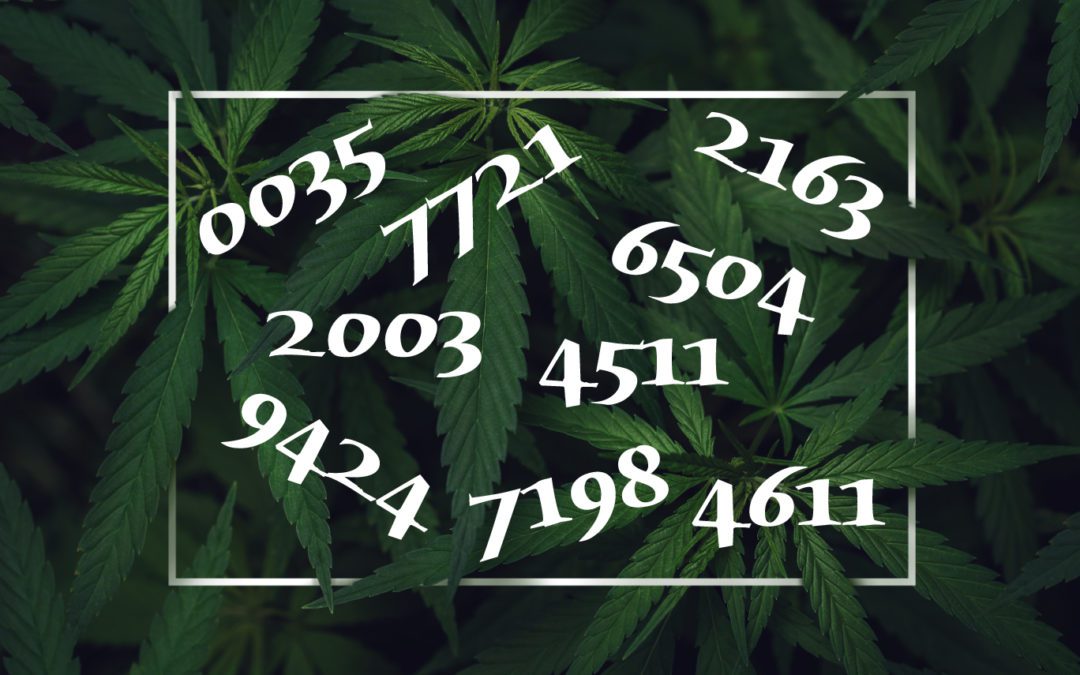

To reinforce why the combination of AI and human expertise matters, here are the top 10 most commonly misused class codes. Spotting these early avoids underpricing, overpricing, audit headaches, and coverage gaps.

Jencap: Your Secret Workers’ Compensation Weapon

From high-hazard industries to multi-state operations and USL&H exposures, our dedicated team of Workers’ Compensation brokers knows how to tackle even the toughest risks. Whatever your client’s payroll size, class code, or experience modification factor, we’ll find the right carrier partner and policy, every time. And we’ll do it faster.

With the help of AI-enhanced tools that read ACORDs, loss runs, and submission data in real time, we can quickly identify the best-fit markets, uncover underwriting red flags, and develop creative placement strategies.

Coverage solutions include:

- Guaranteed Cost

- Small, Mid-range, or Large Deductible Plans

- ASO & PEO options

- USL&H, OCSLA, FELA, DBA, and Foreign Coverage

- Excess Workers’ Compensation

- Loss Sensitive programs

- VCAP

- Or a custom solution for a hard-to-place class

Bottom line? Jencap brings the insight, speed, and flexibility you need to close more business and keep clients covered, no matter how complex the exposure.

Featured in PC360: Jencap Experts on AI’s Impact

When the leading industry publication PC360 wanted insight into how artificial intelligence is reshaping workers’ comp, they turned to Jencap. Our experts break down how AI is transforming quoting, claims, and the overall market — and what that means for agents navigating today’s evolving landscape.

Related Articles

Stay Ahead — Get Exclusive Industry Intel

Subscribe to Jencap’s agent communications for insider insights, hot new product and program launches, and updates on industry change.

Subscribe Now!

We respect your privacy and will only use your information to send relevant updates. You can unsubscribe anytime.

© 2025 Jencap Group LLC. All rights reserved.